It’s exciting when your practice starts growing and you start seeing the benefits of being a physician and an entrepreneur at the same time. The next logical step then becomes creating a professional medical corporation and using it to better your finances.

This, however, is a major decision – one that requires you to consider multiple factors such as what’s right for your career and how this incorporation would affect all aspects of your financial plan.

What does a medical corporation mean?

When you incorporate, you create a fresh legal identity (the corporation) that becomes the owner of your medical practice. Simply put, incorporation refers to a separate legal “person” from yourself.

This means you will run your medical practice through a separate name and all revenues, expenses, debts, and assets would be generated and recorded through that name. This will be separate from your personal income and property.

Most medical practice owners usually incorporate to benefit from certain tax advantages. However, it isn’t a decision that you should take lightly. There are multiple factors to consider (both personal and professional) and running it by a lawyer along with someone who’s done it before would be good before you take the step.

Advantages of Incorporating Your Medical Practice

The alternative to incorporating is running your practice in your own name. However, a lot of doctors choose to incorporate primarily because of the tax benefits. Some benefits include:

1. Income tax savings

In Canada, tax rates for individual doctors are much higher compared to the tax rates for medical professional corporations. Your medical corporation will pay a significantly lower rate of tax and you will only be taxed on your personal income.

2. Tax deferral

When you earn money as an individual doctor, you’re required to pay the taxes in the year that you earn that money. However, this rule doesn’t apply when you incorporate your medical practice. In the latter scenario, you take out the money that you need from the corporation and pay a personal income tax on that money.

The money that you do not take out from your medical corporation, stays in your company and does not get added to your personal income tax. Rather, this money gets taxed at a lower corporate tax rate.

3. Income splitting

Canada has a graduated tax scale. By incorporating your medical practice, you can pay dividends to all shareholders and income to all your employees. This allows a married couple to pay less tax on the same amount of household income if they incorporate their practice. However, income splitting for tax purposes is now more limited than it was just a few years ago (unless you’re in Ontario), so double-check with your accountant to see if you qualify for certain exclusions and can still benefit from income splitting.

Disadvantages of Incorporating Your Medical Practice

While the advantages are great, there are a few disadvantages to forming a medical corporation. The major drawback is that corporations require a ton of paperwork. Here are a few things corporations are required to do:

-

Deal with increased costs involving legal, administrative, bookkeeping, and accounting fees

-

Corporations in several Canadian provinces have to pay a provincial health tax once the corporate payroll has exceeded a certain threshold.

-

Corporations do not protect a medical professional from malpractice liability

-

Provide a formal notice to all your shareholders

-

Keep up to date records of all your corporate activities

However, a lawyer can help you manage all these and iron out all the other details.

Steps to follow when incorporating

While different provinces have different methods, here’s a basic flow of what you need to do:

1. Find a lawyer

Find a lawyer who can help you submit and legalize your incorporation application. This is mandatory and you cannot incorporate your medical practice without the help of a lawyer.

2. Choose a corporate name

When picking a corporate name, make sure that it is not copyrighted or trademarked. Your lawyer can help you find a name that no one has incorporated through the Corporate Registry. The whole process normally takes up to 15 days, however, for a little extra fee you can expect a 24-hour turnaround. If the name you want is available, you’ll receive a reservation that’s good for 2 months.

3. Submit all the certificates

Once you have all the documents and application (depending on the province you’re in), your lawyer can submit it. These typically include a ‘Certificate of Authorization’ and/or a ‘Professional Corporation Application.’ This whole process can take up to 4 to 6 weeks. Your lawyer will take care of any additional information or document that might be needed during this period. Once you get an approval and pay the fee, you’ll be added to the Corporate Registry.

Are you ready to incorporate your medical practice?

Although incorporating your medical practice comes with great perks, you should be careful in following the guidelines set by your governing body. Also, consider all the options with regards to your tax planning strategies.

By doing the right tax planning in advance with the help of your accountant and lawyer, a professional corporation can offer great income tax savings. On the legal front, your lawyer must chalk out the corporate share structure properly, in order to amplify your tax savings, provide the most flexibility for changing circumstances and to avoid any kind of tax traps in the future.

The fees and detailed steps relating to the planning, structuring and preparation of legal documentation to incorporate your medical practice will vary depending on the situation and your province. However, the investment is usually compensated by the tax savings

in the very first year of your practice becoming a corporation.

There are many advantages to the incorporation of a professional practice. However, a decision to incorporate should only be made after considering the pros and cons with your professional advisors, taking into account your personal situation.

This article offers general information only and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Ventures Inc. or its affiliates.

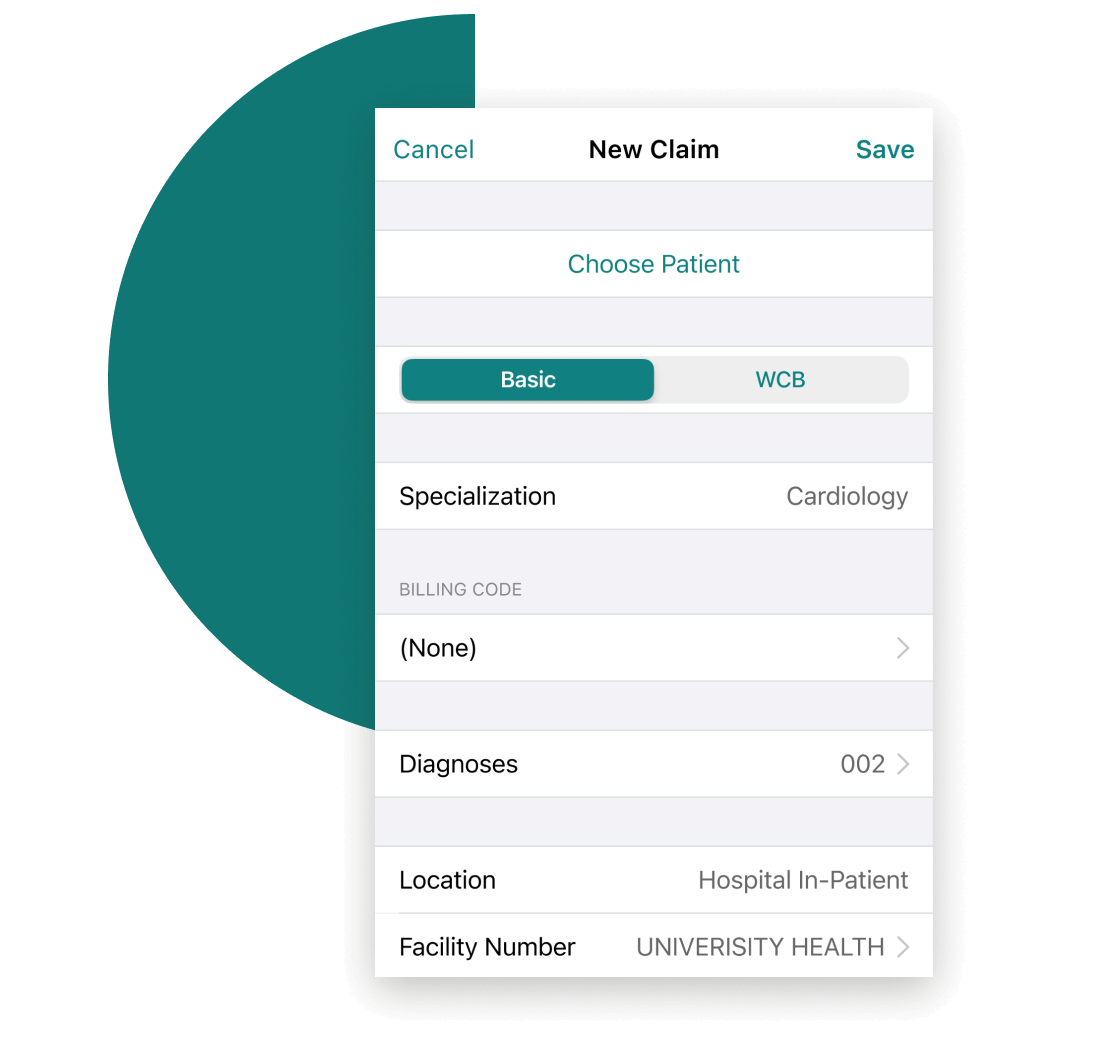

Solutions Designed For The Unique Needs Of Your Practice

Get a $150 Credit when you sign up for Dr.Bill*. No credit card required.