Physician Burnout has always been an important topic within the healthcare system and remains a growing concern among many Canadian doctors.

Even the Canadian Medical Association (CMA) has validated the importance of physician health and recognizes that wellness needs to be a top priority in order to reduce burnout. In an attempt to evaluate relevant issues that Canadian physicians face, the CMA

surveyed over 3,000 of its members.

Here are some insightful statistics they found:

- Doctors with 5 years or less were reported experiencing higher rates of burnout and low resilience than any other physician.

- Female Physicians have a higher risk factor for burnout.

- Physicians whose main practice setting was a hospital had increased odds of lower emotional well-being, lower social wellbeing and lower psychological well-being, compared with those working in other settings.

- More than 80% of respondents said they were aware of physician health programs available to them; however, only 15% reported having accessed one. The main reasons for not accessing physician health programs were that they believed the situation was not severe enough or that they were too ashamed to seek help.

“Despite concerted efforts to promote and protect the health and wellness of physicians, the collective state of physician health remains a significant threat to the viability of Canada’s health system.”

The CMA.

The survey concluded that future analyses will try and identify individual and systemic predictors of the current survey’s negative outcomes (like those specific to women and physicians in their first five years of practice) in hopes to create an actionable plan aimed to improve the wellness of Canadian doctors.

How Traditional Medical Billing Contributes to Burnout

In a similar study, paperwork is said to be the #1 cause of physician burnout. In Canada, over 80% of physicians are reimbursed under a ‘ fee-for-service‘ model in which they submit claims of who they saw and what they did to their provincial health authority.

This ends up creating a lot of extra paperwork, on top of an already full schedule, all just in order to get paid. Worst of all, a lot of doctors tend to let billing pile up and end up spending ‘pajama time’ trying to catch up .

When we speak with physicians, whether they’re a GP or a specialist, we always hear the same complaints when it comes to billing:

-

Medical Billing is Time-Consuming

Billing typically involves mountains of paperwork. Not only is this cumbersome, but it makes it hard to keep track of patients, claims, and how much you’re actually getting paid.

-

Medical Billing is Complicated & Confusing

Medical billing is complicated. There are so many codes, premiums and special circumstances to remember.

Sometimes it’s hard to know if you’re doing it right. The only telltale sign is if you get a rejection on your remittance report, otherwise, you might be under-coding or not taking advantage of premiums without ever knowing you’re actually missing out on these easy extras.

In a past study by the CMA they showed that the average physician fails to bill for at least 5% of the insured services they provide, whether this is due to inaccurate charges or rejected claims. They estimate this translates to forgetting to bill up to $24,000 per year (or $480,000 over 20 years) – That’s a lot of lost money!

It’s safe to assume then, that most physicians hate billing – yet – it’s a vital component of being a physician as you inarguably have to do it in order to get paid. Therefore, it’s no wonder that physician burnout relates so closely to the very complicated component that determines how much money you’re going to make.

Luckily, burnout is both reversible and preventable. So while you can’t get rid of billing, or paperwork in its entirety, what can you do in order to cut back on after-hour admin tasks and reduce your risk of burnout?

There are two possible options when it comes to medical billing; outsourcing and mobile billing.

1. Outsourcing

If you’re reading through this and just can’t be bothered, there’s always the option of outsourcing your billing to a third-party service that will go over your notes and manually process each claim. This is great for someone who is extremely busy and wants to focus on patient-care without the worries of running a practice.

The downside is that you lose the ability to directly see what’s going on with your claims and your overall income. This might mean lost revenue from inadequate billing or rejections that aren’t being followed up on.

Essentially, your billing becomes a black box and a lot of your questions will go unanswered. What’s the status on my recent claims? Is there an issue with my patient’s information? What claims are being rejected? What kind of premiums are available to me? Not having access to 24/7 live reporting makes it difficult to make sure you’re your claims are being handled properly.

2. Mobile Billing

Mobile billing streamlines your practice by automating the entire billing process. No more paperwork, no more rushing over to a computer or jotting down notes to remember what you’ve done. With mobile billing you can submit a claim and bill for a procedure all in one step.

Essentially, it’s the best option in order to get your billing done right away. Most mobile billing companies also have online platforms for detailed reports so you’ll always know where your claims are at and how much you’re getting paid.

***If you are dead set on outsourcing but still like the idea of mobile billing, both you and your MOA can set up an account on Dr-Bill and work as a team. This way your MOA can submit claims for you but you can still see reports and easily check on the status of those claims.

How You can Use Mobile Billing to Beat Physician Burnout

Using your phone to submit claims will speed up and simplify the entire claim

process! This means you can use mobile billing to take away the burden of billing and beat physician burnout by:

- Saving Time

- Earning More Money

- Managing Claims Securely

- Keeping Accurate Records & Getting a Return on Investment

Save Yourself Some Time

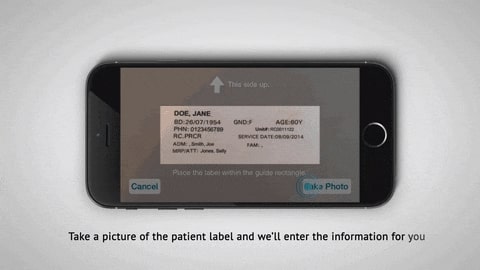

Mobile billing lets you use your smartphone to add a patient and submit a claim all within 30 seconds.

The general process is:

- Take a picture of the patient label

- Log a claim

… sounds easy enough right?

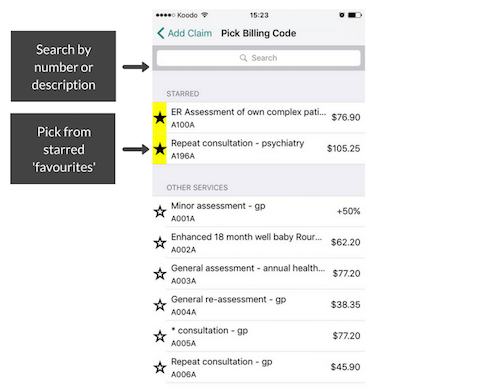

Systems like ours are built on a database of the various billing codes for each province, making it easy to look up and apply the correct code. This is a HUGE time saver and will also reduce the chances of getting rejected claims since you’ll be able to easily find the code you need.

In this day and age, there’s almost no need for physical paperwork. By setting everything up through your smartphone, you’ll save time by allowing yourself to track what you’ve done faster, easier and overall more efficient than you normally would be able to using only a pen and paper.

In a recent survey we asked our users how much time has our mobile billing app saved them and the majority reported around 5-10 hours monthly. That’s a nice chunk of time you’d probably like to spend on…. almost anything else right?

Earn More Money

One of the perks of mobile billing is that the software can capture all services you deliver when you’re out of the office, such as when you’re on call or at the hospital – just bring your phone with you!

It’s generally just easier to set reminders for complex billing, premiums or any extras you might qualify for. By simply knowing what’s eligible and being able to enter it into an app right away you’ll stay on top of the little items that may have otherwise slipped through the cracks.

For example, at Dr.Bill you’ll get alerts for claim issues, instant notifications when your patient doesn’t have insurance and prompts to help add claims correctly. We even have real-time billing agents who are available to help, just in case you want to double-check something or ask for advice. On most of our plans, our billing agents also handle rejections for you, which means it’s just one less thing you need to think about.

Manage Claims Securely

Data security is important, and a well-built software infrastructure can provide a secure way to store and manage claims. This adds an extra layer of security over any paper filing system.

For our users, we protect access to your account with the latest security features:

- Bank-level encryption on your phone, in transit and on the web servers.

- Two-factor authentication limits unauthorized access to your account.

- PIN protected access to your app & patient lists

We make sure that every aspect of our system complies with relevant privacy legislation (including PIPA and FOIPPA). Our system also keeps your patient data secure on Canada-based servers.

Keeping Accurate Records & Getting a Return on Investment

Getting a return on investment is easy with mobile billing apps as Software-as-a-Service (SaaS) applications require lower upfront costs and ongoing monthly fees. These solutions are delivered over the web – which means there’s no downloading required.

Besides being able to use your smartphone to bill right away- you can log in online to check reports and follow-up on claims. Knowing which claims get rejected most often and which services are eligible for premiums, you’ll be able to make data-driven decisions to increase revenue.

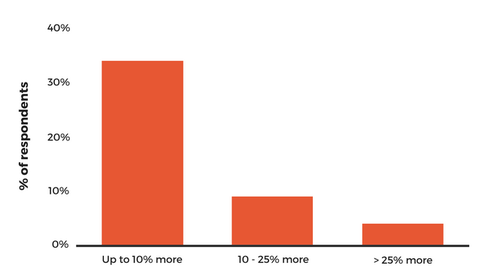

We surveyed our own users, and about half said they earned more by using our mobile billing solution. Some even said they earned over 25% more!

Examples of Mobile Billing Features

Here’s some cool features we have that have been proven to help our users:

Label Snaps:

A Label Snap lets you capture patient data instantly using your phone’s camera. Immediately afterwards you can then log a claim for that patient, or save it for later on.

Duplicate past claims

If you see a patient you’ve previously billed for and would like to bill the same exact thing (or something similar), you can go ahead and create a duplicate claim. Duplicate claims will create a new claim with the old claim’s information.

Multi-bill Claims

You can Bill multiple claims at once. If you see a patient and need to bill several different fee codes they can be grouped together as a single counter.

Note: This feature is very popular for Ontario Physicians. If you’re interested in OHIP Billing check out the Ultimate OHIP Billing Guide.

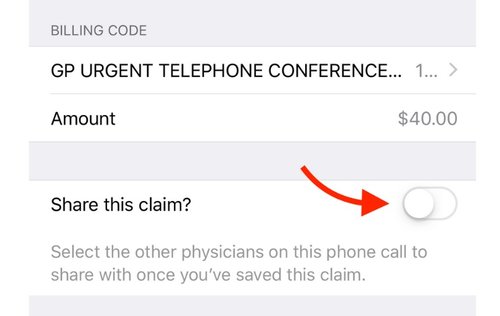

Shared Claims

You can share claim details for phone calls and patient conferences with all participating colleagues. This will easily facilitate everyone to create claims without having to re-enter the patient and claim details.

Best of all? You can even share claims with someone who is not a Dr.Bill user. They will be notified by email with a link to a secure page where they’ll be able to see the claim details. You can share claims both on your iPhone, and on the Web.

Patient Groups

You can create patient groups to help organize your workflow. On the mobile billing app click on ‘ Patient Groups’ on the home screen and click on the plus sign to create a group.

Collaborate & Work in Teams

We can set you up in teams, whether that means your MOA will be billing for you or you’re working in a group. You can share important billing information with your team members, import relevant data from your EMR (or other clinical software) and more. If you’re interested in learning more about teams, it’s best to reach out and let us know what you’re looking for to see exactly how we can help.

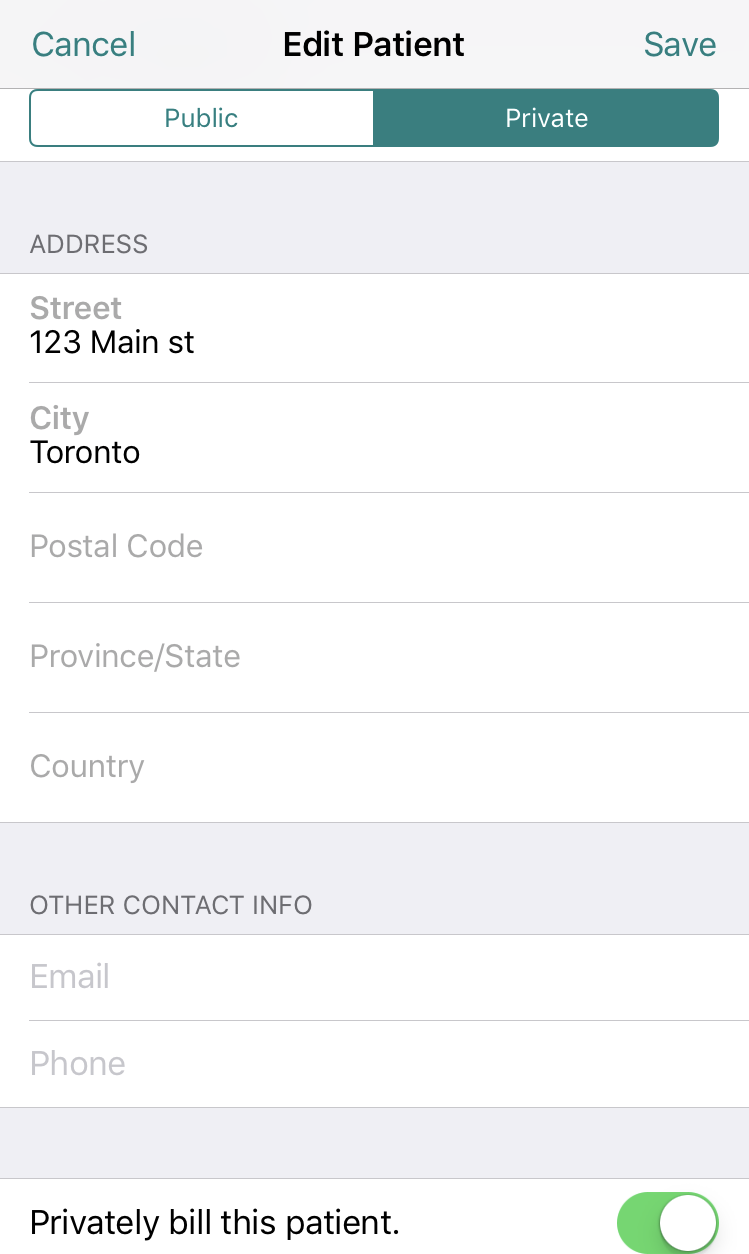

Private Invoices

If you see a patient that doesn’t have insurance, you can still get paid through private invoicing.

When you add or edit a patient, just click on ‘private’ instead of ‘public.’

We will then issue the patient an invoice, collect the payment, then pay you.

The Bottom Line

Mobile billing apps are a great way to save time and streamline your practice by including it into patient-care. Medical billing shouldn’t be that complicated, and shouldn’t be contributing to the overall stress of being a doctor.

Instead, it should be as easy as seeing a patient then tapping a few buttons to submit a claim. If mobile billing sounds like it would suit your practice then say goodbye to paperwork and clunky programs and give it a try today.

This article offers general information only and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Ventures Inc. or its affiliates.