Whether you’re a new doctor or a seasoned veteran, rejections happen! Remembering all of OHIP’s rules isn’t always easy, especially if you’re busy, distracted, or just starting out. However, making mistakes in your billing can cost you more than just time – these mistakes can mean a delay in getting paid or earning less money than you’d originally planned, so it’s important to make sure you’re doing it correctly. To help you out, here are some of the most common reasons for OHIP refusals and rejections – and how to fix them.

Refusals vs. Rejections

When one of your OHIP claims comes back to you, there are two options for what the reason could be. Refusals are claims with simple errors that can be fixed and resubmitted quickly, while rejections are claims that go against billing rules. Both of these can happen when you make a mistake during billing, but rejections will take longer to fix and getting paid for them isn’t guaranteed – so it’s best to avoid these at all costs.

1. Capturing Data

Many billing mistakes can be prevented by making sure you’ve captured and inputted your patient’s data correctly. Make sure to watch out for:

Inputting the wrong PHN

Making sure the patient number you have is correct and that the patient is insured before you bill will save you from realizing important details too late/having your claim rejected. On Dr.Bill, you can use LabelSnap instead of manually entering patient data to input the patient without transcription errors. The software also has live eligibility checks so you’ll be notified of any uninsured patients right away.

Not adding a referring physician

Claims for consultations and visits without a referring physician added will end up refused, so double check that you have one listed. In our experience the majority of refusals are due to this!

Not meeting code requirements

Come claims are refused or rejected because the requirements in the schedule of benefits aren’t met – for example, if you bill 8 minutes for a service with a minimum of 15, you aren’t meeting the requirements for that fee code and the claim can’t be processed correctly.

Billing an item requiring another billing code

Come billing codes can’t be used alone – for example, you can’t bill subsequent visit premium E083 without adding another code for a subsequent inpatient hospital visit on the same claim (like C122, C123, C124, etc. – excluding C121).

Your patient’s info doesn’t match OHIP’s file

If the name or birth date for your patient doesn’t match what OHIP has on file, you’re going to get a refusal!

Using the wrong SLI code

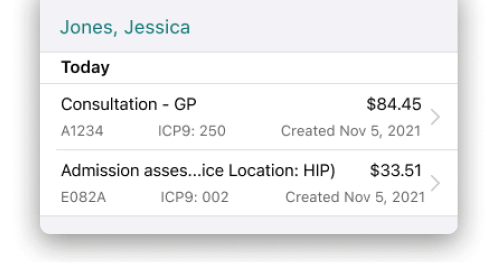

Using one of the 8 Service Location Indicator (SLI) codes is mandatory on your claims submission and tells OHIP where your patient is being seen (whether it’s outpatient, emergency room, etc). Along with this code, you’ll need to add a facility number for their exact location. Depending on the size of the hospital or clinic, you might have multiple facility numbers to choose from for the specific department or location on site, but in order to have your claim accepted, the fee code, SLI code, and facility code should all match. Using an SLI with the wrong fee code – for example, billing C095A (inpatient consultation) with the SLI code HOP (for hospital outpatients) – will end up being rejected.

Forgetting the admission date

When you bill a C-code for inpatient visits, you must have an admission date added to the claim – this applies to all codes you bill as hospital inpatient, including A codes with C premiums, A codes with K premiums with E082, or C codes. You should also make sure that this admission date correctly matches the date of the admission assessment in order for your claim to be accepted.

Adding referring physician incorrectly

Referring physicians must be added under their unique 6 digit OHIP billing number, but a common mistake is to add them under the 5-digit CPSO number registered with the College of Physicians and Surgeons of Ontario. The CPSO number is what allows you to practice medicine in the province but the OHIP number is the one you’ll need for billing, since it tells the Ministry of Health exactly who and where you are. Claims using the wrong number will be refused or rejected, so double check with the referring physician (or your billing software) to ensure you have the right information on file.

2. Special Visit Premiums

In addition to regular fee codes, you can also bill OHIP for special visit premiums, which work like a bonus on top of the regular amount you’d earn. These are meant to incentivize specific specialties or sub-specialties, as well as doctors who work weekends, late at night, or over the holidays. While billing these premiums can improve your monthly income, it can also lead to more rejections if billed incorrectly.

In general, you are allowed to use special visit premiums for any non-elective (urgent and emergent) consults and assessments in specific situations. These situations include:

Travel premiums: if you have to travel to the patient’s hospital from anywhere else (including a different hospital or clinic), you are allowed to charge a premium for this time

First seen patient: you are allowed to bill a premium for the first patient you see (and are allowed to bill again after midnight if your shift is still going)

Additional persons seen: you are also allowed to charge a premium for each additional patient seen after you billed your first.

The dollar amount of this premium will change depending on the time of day, but it’s important to remember that these codes cannot be used for routine rounds, visits to admit elective patients, or subsequent hospital inpatient visits. Any premiums you bill must be billed together with visit fees, and the ‘A’ prefix should always be used. If you’re planning on using any of these billing premiums, watch out for these common mistakes:

Using the incorrect prefix

Since C prefix codes are for non-urgent inpatient visits, billing special visit premiums requires an ‘A’ prefix and a visit fee. Make sure you’re choosing the right fee code and that this fee code matches the SLI number on the claim.

Using the wrong time of day

Make sure you select the correct time of day based on one of the five different time brackets. Billing for a premium with the wrong time could lead to the claim being rejected.

Using travel premiums incorrectly

Travel premiums apply only to the first patient you see – any further patients should be billed with the ‘additional patients seen’ premiums, not travel.

Using premiums for counselling appointments

Special visit premiums only apply to situations where you’re asked for unexpected travel from one place to another. Since counselling appointments are technically pre-booked, using special visit premiums on counselling codes is incorrect and will be rejected.

3. Consults & Visits

When you’re billing for consultations and patient visits, make sure to remember that on any consultation, OHIP requires a referring physician. This is a small detail, but it’s also one that can be easily missed! Double check that this field is filled out before you click save, and remember to use the referring physician’s correct OHIP billing number. If you’re an OB/GYN, remember that midwives can only refer for midwife related assessments A813, A815, and A816.

Lastly, be careful with billing for two consultations on the same date – these claims will be rejected, since billing duplicate consultations with a patient on the same day is against the OHIP rules.

Conclusion

Keeping on top of all of the OHIP rules and regulations might not be the most fun activity, but it’s essential to know in order to avoid payment delays, claim rejections, or leaving money on the table.

This article offers general information only and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Ventures Inc. or its affiliates.

An OHIP Expert in Your Pocket

Find codes and bill premiums with a tap. Get a $150 Credit when you sign up for Dr.Bill*.

.

.