If you’re a Residential Care Practitioner then you’re likely working with patients who have chronic disease or terminal illness. Your schedule might be unpredictable as you’re often called in after hours to care for your patients. You might also need to spend time speaking with your patient’s families, dealing with distress or discussing treatment options.

While some days are easier than others, it’s important to make sure you get compensated for all of the hard work you do. Luckily, there’s a good selection of MSP residential care fee codes, although each fee code comes with its own set of rules and guidelines of when you can and cannot use them.

In an attempt to make things easier, we’ve put together a quick guide of MSP Billing tips for Residential Care Practitioners.

Bookmark this page for easy-referencing, or for a printable PDF that you can hang up in your workspace scroll to the bottom.

Residential Care MSP Billing for Routine visits to the facility:

Residential Care Visit Fee: 00114

You can bill this every 2 weeks, as warranted. If you make visits more often than that, MSP will still pay them, you just need to submit 00114 with a diagnostic code that explains why you had to see the patient again (for example, a UTI, pneumonia, delirium, sepsis, CHF, etc). Then, in the MSP note field of your claim, give a short explanation such as: intercurrent illness – UTI, intercurrent illness – delirium.

First Visit of the Day Bonus: 13334

Bill 13334 for the first patient you see that day. It has to be billed with 00114 (Visit to the nursing home for one or multiple patients).

You can only bill this once per day.

Residential Care MSP Billing for Terminal Care:

Visit for Terminal Care: 00127

You can submit 00127 before your patient dies and you can bill it daily, if daily visits are needed. You’re eligible to bill it from the time your patient is deemed palliative up to 180 days prior to death. All your visits must be documented.

You may wish to visit dying residents first, so you can bill the higher fee. The diagnostic code must demonstrate a terminal illness. If this is your first patient of that day, you can bill the 13338 bonus (but not 13334 and 13338).

Yearly Complete Exams

Complete examination (out of office):

16201 (age 60 – 69)

17201 (age 70 – 79)

18201 (age 80+)

Residential Care MSP Billing for Telephone calls (for an order or concern):

Telephone advice: 13005

If a nurse, or other healthcare professional, calls to discuss a resident or needs an order that can be done over the phone you can bill for it using 13005.

***Do not bill this if you’ve already billed another service (i.e., not with 00114, complete, 14077).

Residential Care MSP Billing if your Called Out to see the Resident:

Residential Care Visit Fee if called to see (one resident only): 00115

You can bill 00115 if you’re called between the hours of 0800 and 1800 to see the resident. In order to avoid rejections, you need to make sure the time of the call is recorded.

While you’re there, if you see any other residents bill 00114.

Residential Care MSP Billing if your Called after hours:

When called after hours to attend to an ill resident, you can bill the “out of office” visit PLUS the surcharge. In this case, you would not bill 00114.

16200 Visit – out of office (age 60 – 69)

17200 Visit – out of office (age 70 – 79)

18200 Visit – out of office (age 80+)

Call out Charges

You can bill a call out charge if:

- You are called specially to see the resident.

- It is a non-elective medical reason for the visit.

- You must travel from home or office to render the service.

- The call was made out of office hours (as seen below):

01200 Evening: call placed 1800-2300hrs

01201 Night: call placed 2300-0800 hrs

01202 Saturday, Sunday and Statutory Holidays: 0800-1800

QUICK TIP:

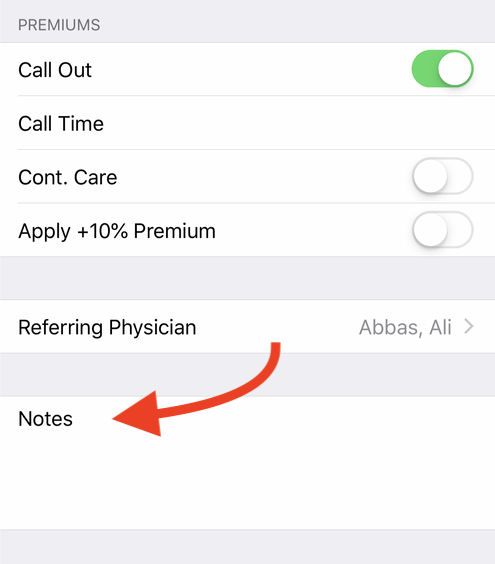

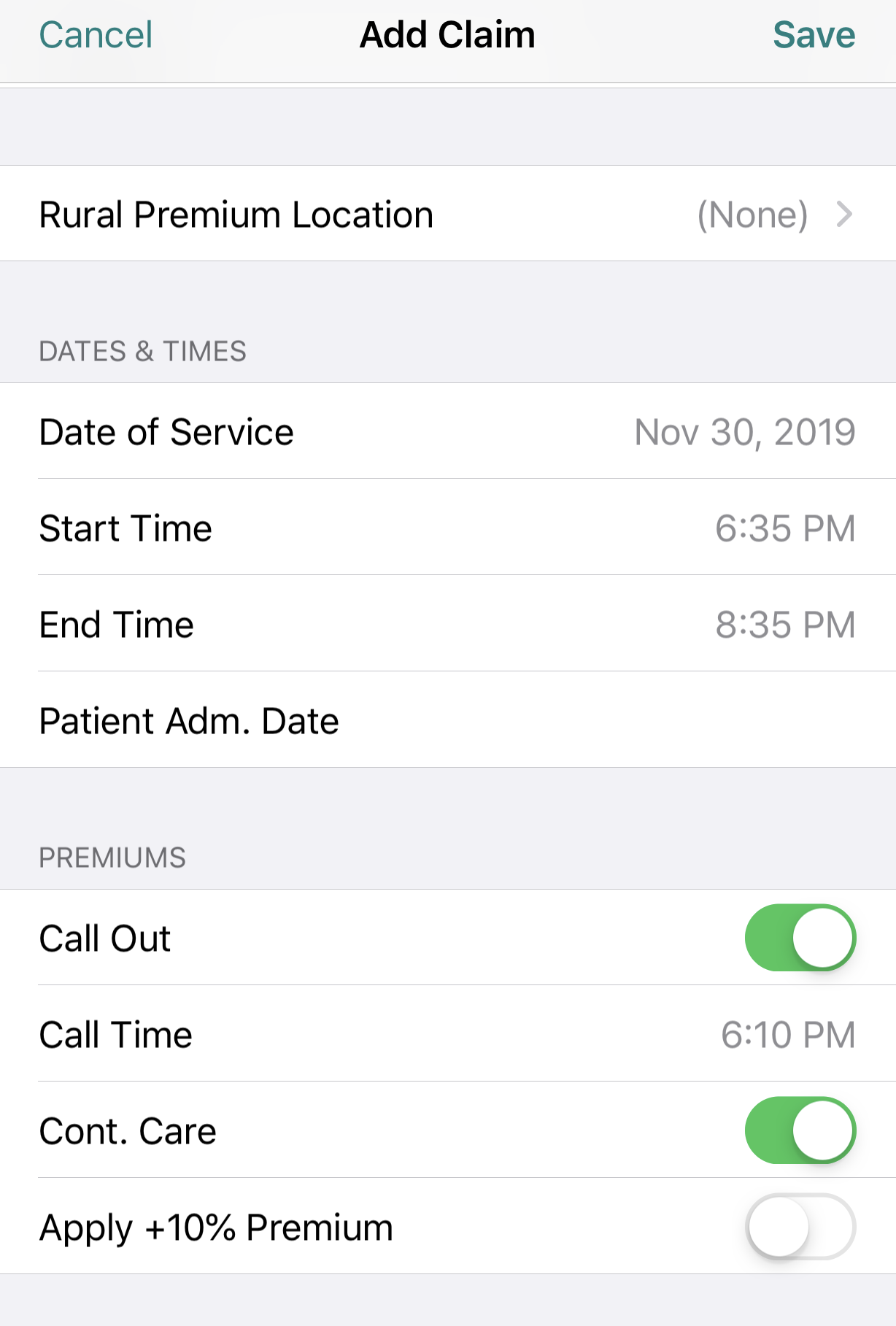

If you’re using the Dr.Bill app, log your claim like you normally would then, at the bottom of the claims toggle ‘Call Out.’ Don’t forget to enter the ‘Call Time,’ ‘Start Time’ & ‘End Time’ for your encounter. Our mobile app will automatically apply the correct Out of Office premiums to your claim. The call out charge applies only to the first resident seen.

If you’ve logged a Call Out charge and then continue to see additional patients you would be entitled to bill continuing care surcharges for each 30 minutes after the initial 30 minutes you spent with the patient you were initially called to see.

For Continuing Care, you’ll enter the times seen for each patient at the end of a 30 minute block and the units will be automatically calculated. Enter CCFPP in the notes field to indicate that the patients were seen as part of the same call out and you will not be deducted the 30 minute refractory period.

To apply this premium toggle both ‘Call Out & Continuing Care’. Like this:

Medical billing in BC is confusing and can often be overwhelming. To help out, check out our complete MSP guide that walks you through each step of medical billing – from the general teleplan process to maximizing your claims and using mobile billing.

Residential Care MSP Billing Tips for Conferences/Meetings:

Facility Patient Conference Fee: 14077

(per 15 minutes).

This fee is for attending your resident’s care conference.

Max/day/resident = 30 minutes;

Max/year/resident = 18 units.

You can also bill 14077 (with the same restrictions) if asked to meet with other health professionals (pharmacists, dietitians, etc.) about a resident on an informal basis via phone or in person.

If you’re attending a conference or meeting, make sure document which healthcare providers are there (e.g. CNL, RN, MD met to discuss Mrs. C.’s agitation). You can also bill a visit fee (00114) in addition if medically indicated. You must indicate the stop/start time of the conference and V15 code (frail elder).

Telephone Management Fee (‘GP for Me’ Incentive): 14076

You can bill this for any clinical phone discussion between a patient’s representative or family, or health professional about the resident. You can bill this with 14077 if done on the same day. However, you cannot bill it with 00114, or any other services.

Dealing with Distress in Resident / Family; and/ or Psychiatric Counselling and/or Completion of MMSE

Individual Counselling (out of office):

16220 (age 60-69)

17220 (age 70-79)

18220 (age 80+)

You can bill individual counselling codes for a discussion with residents, or their family members, about the resident’s medical condition, e.g. terminal illness, progressive dementia, resident behaviour that is distressing ,etc.

If you’re speaking with a family member, you can bill for it under the resident’s MSP number or under one the relative’s MSP number. If you bill it under a relative’s MSP number, you can also bill (00114). However, if you bill it under the resident’s MSP number you won’t be eligible to bill (00114).

The discussion must be in person and at least 20 minutes. Counselling codes can be billed a maximum of 4 times per year/per patient.

Chronic Disease Management

GP Annual Chronic Care Bonus – Hypertension: 14052

This is an annual bonus that you can bill each year. Keep in mind, if you’re using 14052, it cannot be billed in combination with any of the following fee codes:

Diabetes: 14050 Dx. 250

Heart Failure: 14051 Dx. 428

HBP: 14052 Dx. 401

COPD: 14053 Dx. 491, 492, 494, 496

RACE

Rapid Access to Consultative Expertise (RACE) is a telephone hotline you call if you need advice. All you do is call the number and a RACE ‘on-duty specialist’ will return your call within 2 hours (often sooner). If you call RACE and speak with a specialist you can bill for it using 14018.

Residential Care MSP Billing Examples

If you’re new to billing residential care, Divisions of BC created an example of a typical billing scenario:

You are scheduled to see 6 of your own patients for routine care and then have a care conference for a 7th patient with a Pharmacist.

You are also asked to see a patient of another MRP with a suspected UTI. Later in the day you are asked to take on a new patient being transferred from the hospital with a hip fracture.

Billing for the day:

00114 + 13334 (for first patient of the day).

00114 – for second patient of the day.

00114 – for third patient of the day.

00114 – for fourth patient of the day.

00114 – for fifth patient of the day.

00114 – for sixth patient of the day.

00114 – for seventh patient of the day. Although not MRP, this is the most appropriate code unless performing a consult out of office or needing a complete exam. Be sure to include a note as well.

14077 – for care conference which lasted 30 min, document times 0930-1000.

14077 – for call pertaining to patient lasting 10 minutes.

What’s missing from these examples:

Out of office examinations

Counselling fees

Premiums

Residential Care MSP Billing Tips

Printable PDF

If you’re interested in other MSP fee codes, save a link to our MSP searchable database below. You can search by specialty, billing code or keyword.

MSP billing codes Searchable Database

Explanatory Codes

If you submit a claim and it doesn’t pass the approval process by MSP your claims may be rejected, reduced or refused. This can happen for a variety of different reasons (around 706 different reasons to be exact)!

In our experience, these are the most common scenarios to watch out for:

- Location of fee code doesn’t match. Ie, radiologic fee code performed in ER

- There’s a fee code conflict – so assessment is required

- Invalid use of Premiums

- No Referring Physician

- Patient doesn’t have insurance

Extra Reminder: A lot of errors are a direct result of either not adding a referring physician OR not double checking that your patient has insurance. So, make sure you always check these two things before submitting a claim.

When it does occur, you’ll be given an explanatory code for why each rejection, reduction or refusal happened. To find out what the code means find a description below:

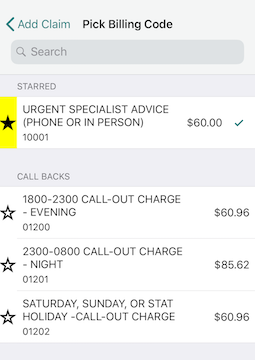

Starring:

If you’re billing with Dr.Bill you have the option of ” starring” your most commonly used billing codes. That way, they’ll appear at the top for easy-searching.

If you found this useful, or would like to see more MSP billing tips, let us know on twitter.

This article offers general information only and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Ventures Inc. or its affiliates.

Claim Your $150 Credit!

Get a $150 Credit when you sign up for Dr.Bill*. No credit card required.

*Terms and conditions apply.