If you’re a GP in British Columbia, navigating MSP fee codes can feel overwhelming. Your specialty uses a very wide range of codes, increasing your risk of underbilling for your work and missing out on income.

This quick guide gives you a clear overview of GP fee codes in BC, plus practical tips for billing them correctly. Whether you’re new to practice or an experienced physician, we find there are always way to improve MSP billing accuracy.

Want more tips on optimizing your billing? Read our blog article, 10 MSP Billing Tips to Help You Avoid Rejections and Optimize Claims.

Consultations

When seeing a patient for the first time you’d bill a consultation or a complete examination.

You can only claim a consultation when it’s been specifically requested by the attending practitioner. This means that on every consultation claim you need to have a referring physician.

Consultation fee codes are billed in age groups and whether the patient was seen in or out of the office.

In Office GP Consultation Fee Codes

12110 Consultation – in office: (age 0-1)

00110 Consultation – in office: (age 2 – 49)

15310 Consultation – in office (age 50 – 59)

16110 Consultation – in office: (age 60 – 69)

17110 Consultation – in office: (age 70 – 79)

18110 Consultation – in office: (age 80+)

Out of Office GP Consultation Fee Codes

12210 Consultation – out of office (age 0 – 1)

13210 Consultation – out of office (age 2 – 49)

15210 Consultation – out of office (age 50 – 59)

16210 Consultation – out of office (age 60 – 69)

17210 Consultation – out of office (age 70 – 79)

18210 Consultation – out of office (age 80+)

Special in hospital consultation

00116: Special in hospital consultation

00116 applies to consultations done on in-hospital patients of an acute or extended care (or when the patient is in the ER with a complex problem as outlined below and a decision has been made to admit).

- It needs to be referred to you by a certified specialist (FRCP, FRCS or CCFP-EM) for advice about and/or the continuing care of complex problems for which the management is complicated and requires extra consideration. Examples of such problems include (but are not restricted to) the assessment of terminal illness, the planning of activation/rehabilitation programs and the management of patients with AIDS.

- Not applicable for transfer of care.

- Not applicable if the patient has been attended to by you or a physician in the same group in the last 6 months.

Complete Examination

When you do not have a referral from another physician or healthcare practitioner, you can bill a complete examination.

A complete examination needs to include a complete detailed history and detailed physical examination of all parts and systems. In the history you should include complaints, history of present and past illness, family history, personal history, functional inquiry, physical examination, differential diagnosis, and provisional diagnosis.

The fee codes for complete examinations are billed by age group and whether they are seen in or out of the office.

In Office GP Complete Examination Fee Codes

12101 Complete examination – in office (age 0-1)

00101 Complete examination – in office (age 2-49)

15301 Complete examination – in office (age 50 – 59)

16101 Complete examination – in office (age 60-69)

17101 Complete examination – in office (age 70-79)

18101 Complete examination – in office (age 80+)

Out of Office GP Complete Examination Fee Codes

12201 Complete examination – out of office (age 0-1)

13201 Complete examination – out of office (age 2-49)

15201 Complete examination – out of office (age 50-59)

16201 Complete examination – out of office (age 60-69)

17201 Complete examination – out of office (age 70-79)

18201 Complete examination – out of office (age 80+)

Consults and Complete Examination Reminder

You can only bill for a consult or a complete examination once every 6 months. If you happen to see the patient again within the 6 months you need to add a note in the note field of the claim telling MSP what the medical necessity was and why you had to see them again. MSP will then review the claim and decide if it’s eligible or not.

Visits

Visits differ from a consultation or complete examination because consults/exams require a full history and complete exam while a visit requires a partial or regional exam. For example, when you see a new patient you’d give a full examination but when you’re seeing a regular patient for a complaint (like a cold, headache, etc.) you’d bill a visit.

You can bill visit fee codes for any condition requiring partial or regional examination and history. This includes both initial and subsequent examination for the same or related condition.

Visit fee codes are also billed by age groups and whether they are seen in the office or out of office:

GP In Office Visit Fee Codes

12100 Visit – in office (age 0-1)

00100 Visit – in office (age 2-49)

15300 Visit – in office (age 50-59)

16100 Visit – in office (age 60-69)

17100 Visit – in office (age 70-79)

18100 Visit – in office (age 80+)

GP Out of Office Visit Fee Codes

12200 Visit – out of office (age 0-1)

13200 Visit – out of office (age 2-49)

15200 Visit – out of office (age 50-59)

16200 Visit – out of office (age 60-69)

17200 Visit – out of office (age 70-79)

18200 Visit – out of office (age 80+)

Counselling Fee Codes

Counselling fee codes are billed in age groups as well as where the visit takes place. In order to be eligible to bill a counselling fee code you need to spend at least 20 minutes with the patient.

GP In Office Counselling fee codes

12120 Individual counselling – in office (age 0-1)

00120 Individual counselling – in office (age 2-49

15320 Individual counselling – in office (age 50-59)

16120 Individual counselling – in office (age 60-69

17120 Individual counselling – in office (age 70-79)

18120 Individual counselling – in office (age 80+)

GP Out of Office Counselling fee codes

12220 Individual counselling – out of office (age 0-1)

13220 Individual counselling – out of office (age 2-49)

15220 Individual counselling – out of office (age 50 – 59)

16220 Individual counselling – out of office (age 60-69)

17220 Individual counselling – out of office (age 70-79)

18220 Individual counselling – out of office (age 80+)

GP Group Counselling fee codes

00121 Group counselling first full hour

00122 Group counselling second hour

GPSC Annual Bonuses

Management fees provide funding for Family Physicians to identify, manage and improve care of patients. They help compensate for the additional work that goes beyond the office visit.

14033 Annual complex care management fee

14050 Gp annual chronic care bonus – diabetes mellitus

14051 Gp annual chronic care bonus – heart failure

14052 Gp annual chronic care bonus – hypertension

14053 Incentive for gp annual chronic care bonus copd

14250 Annual chronic care incentive(encounter)-diabet

14251 Annual chronic care incentive(encounter)-heart

14252 Annual chronic care incentive(encounter)-hypert

14253 Annual chronic care incentive(encounter)-copd

GPSC Attachment Fees

The GPSC Portal Codes (14070 and 14071) are zero value codes that you need to submit at the beginning of each year if you’re a full-service family physician (or a locum who will cover a full-service family physician). Billing the portal codes signifies that you’re providing full-service family practice service to your patients and you will do so for the entire year.

Without billing the portal codes you won’t have access to the other GP incentive codes listed below:

Portal Codes

14070 attachment participation

14071 locum attachment participation

Incentive Codes

14074 unattached complex/high needs patient attachment

14075 attachment complex care management fee

14076 attachment telephone management fee

14077 attachment patient conference fee

If you’ve billed the portal codes through Dr.Bill before, our billing agents will automatically resubmit them for you. If you haven’t, you need to follow these steps:

How to submit the GPSC Portal code (14070)

Use diagnostic code 780 and the following program “Patient” demographic information:

PHN#: 975 303 5697

Patient Surname: Portal

First name: GPSC

Date of Birth: January 1, 2013

Once processed by MSP, this will then allow access to 14075, 14076, 14077, 14078 and 14029 for the balance of that calendar year.

How to submit the GPSC Portal code for Locums (14071)

The GPSC Locum Portal code (14071) may be submitted by the GP who provides locum coverage for Family Physicians who have submitted 14070. This code will still need to be submitted at the beginning of each calendar year or prior to providing the locum coverage. In order to submit 14071, you’ll need to follow the same exact steps as above.

Other GPSC Fee Codes/Incentives

14063 Palliative care planning fee

14066 Personal health risk assessment

14088 Unassigned inpatient care fee

The GP inpatient care network incentive applies if you’re actively participating in an FP assigned inpatient network, an FP unassigned inpatient care network and/or an FP maternity network. It’s billable in addition to the visit fee code (00109, 13109, 13008, 00127, 14088) or the delivery fee and is a lump sum incentive based on the annual volume of unassigned inpatients.

Before you receive the incentive you need to be a member of the Assigned Inpatient Care Network, which means you need to register for it. You can fill this form out electronically through Dr.Bill. If you’re not a Dr.Bill client, you can print it out and mail it to MSP.

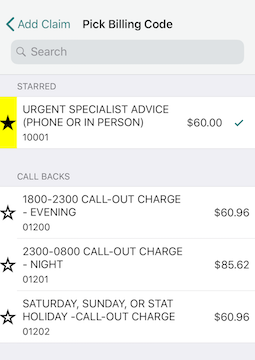

Call Outs & Continuing Care

A call out is a premium added when you are called from outside of the hospital to come and care for a patient.

During weekdays the call must be placed prior to 8:00am or after 6:00pm. On weekends the call must be placed after 8:00am.

REMINDER: If you’re called during regular weekday hours you’d bill an emergency visit instead, which covers both the visit and the surcharge.

To apply this premium to your time, fill out a claim logging your consult or visit with the patient. Then, at the bottom of the claims toggle the ‘Call Out’ button. Don’t forget to enter the Call Time, Start Time & End Time for your encounter. Our mobile app will automatically apply the correct Out of Office premiums to your claim.

Continuing Care

If you have logged a Call Out charge and then continue to see additional patients you would be entitled to bill continuing care surcharges for each 30 minutes after the initial 30 minutes you spent with the patient you were initially called to see.

If you see multiple patients in a 30 minute block you would only log the continuing care on the last patient in that block but for the entire 30 minute period. You must also note CCFPP in the MSP note field to tell MSP that these patients were seen following your initial call out to the hospital.

Continuing Care Rules

Timing begins after the first 30 minutes for consultations, visits or anesthetic evaluations. Payment is based on one half-hour of care or major portion thereof (at least 15 mins.). This means that your first continuing care surcharge is only eligible after 45 minutes of continuous care (30 mins. for the refractory period plus the major portion of 15 minutes).

Timing for the continuing care premium is based on the total time spent providing continuous care, not the number of patients you see. For example, if you see 3 patients within 30 minutes then you would only add the continuing care premium on the last patient, but for the entire 30-minute duration.

To apply these surcharges on Dr.Bill, log your consult or visit with the patient. On that claim toggle ‘Call Out & Continuing Care’. Don’t forget to enter the Call Time, Start Time & End Time for your encounter. Our app will automatically apply the correct Out of Office premiums to your claim.

Reminder: Only toggle Call-Out on the first patient, to show that it was the first. For the following claims just toggle Cont.Care. If you need to claim a call out on its own or aren’t using Dr.Bill then use the following fee codes:

Call Out Fee codes:

01200: Evening (call placed between 6:00pm and 11:00pm and service rendered between 1800 hours and 0800 hours)

01201: Night (call placed and service rendered between 11:00pm hours and 8:00am)

01202: Saturday, Sunday or Statutory Holiday (call placed between 8:00am and 11:00pm)

Continuing Care Surcharge Fee Codes (non-operative):

Billed in addition to visits and consultation fees.

01205: Evening (service rendered between 6:00pm and 11:00pm) – per half hour or major part there of

01206: Night (service rendered between 11:00pm hours and 8:00am) – per half hour or major part thereof

01207: Saturday, Sunday or Statutory Holiday (Service rendered between 8:00am and 11:00pm) – per half hour or major part thereof

Other Types of Various GP Visit Fee Codes

13070: In office assessment of an unrelated condition(s) in association with a WorkSafe BC service

- Paid only when services are provided for an unrelated illness occurring in conjunction with a WorkSafe BC insured service.

- Unrelated service must be initiated by the patient.

- The unrelated condition(s) must justify a stand-alone visit.

- Only paid once per patient per day, and includes all other unrelated problems.

- Not paid if a procedure for the same or related condition is paid for the same patient on same day.

- The visit must be fully and adequately documented in chart.

13075: In office assessment of an unrelated condition(s) in association with an ICBC service

- Paid only when services are provided for an unrelated illness occurring in conjunction with an ICBC insured service.

- Unrelated service must be initiated by the patient.

- The unrelated condition(s) must justify a stand-alone visit.

- Only paid once per patient per day, and includes all other unrelated problems.

- Not paid if a procedure for the same or related condition is paid for the same patient on the same day.

- The visit must be fully and adequately documented in the patient’s chart.

General Practice Group Medical Visit (GMV Fee Codes)

A Group Medical Visit provides medical care in a group setting. A requirement of a GMV is 1:1 interaction between each patient and the attending physician. While portions of the GMV may be delegated to other allied health providers, you need to be physically present for the majority of each session.

All GMV codes are time-based fee codes and you cannot do concurrent billing for any other services. You also cannot use any of the GMV codes if it’s only for a single patient – it must be for a group and applies only when all members of the group are receiving medically required treatment (i.e. each member of the group is a patient).

You can’t use the GP Group Medical Visits for any activities related to attempting to persuade a patient to alter their diet or other lifestyle behavioural patterns.

Group Medical Visit Fee Codes

Group medical visits are billed depending on the amount of patients you see at the same time. So for example if you are doing a group visit of 6 patients at the same time, you would bill 13766 for all six patients (bill it six times once for each patient).

Level Fee per patient, per 1/2 hour or major portion thereof (less that 30 mins but over 16 mins):

13763 Three patients

13764 Four patients

13765 Five patients

13766 Six patients

13767 Seven patients

13768 Eight patients

13769 Nine patients

13770 Ten patients

13771 Eleven patients

13772 Twelve patients

13773 Thirteen patients

13774 Fourteen patients

13775 Fifteen patients

13776 Sixteen patients

13777 Seventeen patients

13778 Eighteen patients

13779 Nineteen patients

13780 Twenty patients

13781 Greater than 20 patients (per patient)

GMV Guidelines:

- A separate claim must be submitted for each patient.

- When a patient attends a group visit, note in his or her chart, along with the start and end times.

- All Claim must include start and end times.

- A minimum of a full thirty (30) minute period and a maximum of ninety (90) minutes may be claimed per patient per day. If you go over 2 ½ hours in any 7 day period you need to leave a note in the MSP note field explaining why.

- It’s not payable with other consultation, visit or complete examination, for the same patient, on the same day.

- Concurrent billings for any other MSP services for any patient during the time interval for which the GMV fee is billed will not be paid.

- If two physicians are involved, the group should be divided for claims purposes, with each physician claiming the appropriate rate per patient for the reduced group size. So for example, if you are doing a group workshop for anti smoking with another physician and there’s 10 people in the group, you’d divide the group in half and each bill for 5 patients.

In the MSP note field leave a note stating “Shared Group medical visit” and identify the other physician.

Home Visits

00103: Home visit (between 8:00am and 11:00pm any day)

- If you see additional patients during the same house call then you’d bill them under the applicable out of office visit fee codes 12200, 13200, 15200, 16200, 17200, 18200 (00103 is basically like a call out fee. So once you are there to see the first patient you are already there to see other patients and do not need to be “called in” again).

GP Facility Visit Fees

00109: Acute care hospital admission examination

You can bill 00109 when a patient is admitted to an acute care hospital specially to receive medical care from you (the GP with active hospital privileges).

You cannot bill it when a patient has been admitted for surgery or for “continuing care” by a certified specialist.

- It’s to be applied in lieu of fee item 00108 on the first in-patient day, for that patient.

- You cannot use it if you’ve billed any of the below fee codes within a week preceding the patient’s admission 12101, 00101, 15301, 16101,17101, 18101, 12201, 13201, 15201, 16201, 17201, or 18201

- Limit of one hospital admission (00109 or 13109) payable per patient per hospitalization. This means that when a patient is admitted to the hospital for treatment only one admission fee code is payable during their entire hospitalization period. You can only bill another admission if the patient was discharged and then readmitted.

00108: Hospital visit

Billable if you have active hospital privileges. Use it for daily attendance on the patients you have most responsibility for.

- Essential emergent or non-emergent additional visits to a hospitalized patient can be billed under fee item 00108. The claim must include the time of each visit and a statement of need included in a note record.

00128: Supportive care hospital visit

00127: Palliative care patient facility visit

- You can bill this as long as it’s doesn’t exceed 180 days prior to death and your patient is in an acute care hospital, nursing home or palliative care patient facility.

- You cannot bill the chemotherapy fee codes at the same time, it’s one or the other. (33581, 33582, 33583, 00578, 00579, and 00580)

Guidelines for 00109, 00108, 00128, 00127

- For weekday, daytime emergency bill 00112.

- If you’re called back to the hospital during the evening, night time or weekend because your patient’s condition has changed you could bill 12200, 13200, 15200, 16200, 17200, 18200.

- If you’re already on-site and called for emergent care, then bill 00113, 00105 or 00123. The claim must include the time of service and an explanation for the visit included in the MSP note field.

- If you need additional visits to a hospitalized patient then bill 00108. You need to leave a note in the MSP note’s field explaining why there was a need for additional visits.

Community Based GP Hospital Visits

The following eligibility rules apply to all community based GP hospital visit fees.

- Only palpable if you’re a GP with an active family practice in the community, and you accept the role of being Most Responsible Physician (MRP) for the longitudinal coordinated care of your patients.

- You won’t get paid for any community based visits if you’ve been paid for any specialty consultation fee in the previous 12 months.

- For weekday daytime emergency visit, bill 00112. For evening, night time or weekend emergency visits bill 12200, 13200, 15200, 16200, 17200, 18200.

- If you’re on-site and called for emergent care, bill 00113, 00105 or 00123. The claim must include the time of service and an explanation for the visit included in the MSP note field.

- Essential non-emergent additional visits to a hospitalized patient for diagnosis unrelated to the admission diagnosis, during one day, are to be billed under fee item 00108 or 13008. The claim must include the time of each visit and note in the MSP note field explaining why.

Community Based GP with Active Hospital Privileges

Active privileges means you have the authority to write orders, whereas courtesy/associate privileges means you’d only be allowed to write progress notes in charts, but not orders.

13109: Community based GP: Acute care hospital admission examination with active hospital privileges.

- It’s to be applied in lieu of fee item 13008 on the first in-patient day, for that patient.

- You cannot use it if you’ve billed any of the below fee codes within a week preceding the patient’s admission 12101, 00101, 15301, 16101,17101, 18101, 12201, 13201, 15201, 16201, 17201, or 18201.

- Limit of one hospital admission (00109 or 13109) payable per patient per hospitalization.

13338: Community based GP, first facility visit of the day bonus, extra (active hospital privileges) (for routine, supportive or palliative care)

- Paid only if 13008, 13028, 00127 are paid on the same day.

- You can only bill this once a day, regardless of the number of facilities attended.

- Not payable on the same day for same physician as 13339 as 13339 is also a first of the day bonus.

13008: Community based GP: hospital visit (active hospital privileges)

13028: Community based GP: supportive care hospital visit (active hospital privileges)

- If you’re the referring physician you can charge one hospital visit for each day hospitalized during the first days of hospitalization and thereafter one visit for every 7 days hospitalized. A written record of the visit must appear in either the patient’s hospital or office chart.

Community Based GP with Courtesy or Associate Hospital Privileges

13339: Community based GP, first facility visit of the day bonus, extra, (courtesy/associate privileges)

- Only payable if 13228 paid the same day.

- Limit of one payable for the same physician, same day, regardless of the number of facilities attended.

- Not payable same day for same physician as 13338.

13228: Community based GP: hospital visit (courtesy/associate privileges)

You can use 13228 for patients in acute, sub-acute care or palliative care.

- It’s only payable once per calendar week per patient up to the first 4 weeks. Thereafter, payable once per two weeks up to a maximum of 90 days. For visits over 90 days you’ll need to add a note in the MSP note field explaining why.

- Not payable with any other visit fee including 00108, 13008, 00109, 13109, 00114, 00115, 00113, 00105, 00123, 00127, 12200, 13200, 15200, 16200, 17200, 18200, 12201, 13201, 15201, 16201, 17201, 18201, 00128, 13028, 13015, 12220, 13220, 15220, 16220, 17220, 18220, 00121, 00122, 12210, 13210, 15210, 16210, 17210, 18210, 00116, 00112, 00111.

- If you’re on-site and called for emergent care, you can also bill 00113, 00105 or 00123.

- If a hospitalist or GP member of an Unassigned In-Patient Care Network, is providing GP care to the patient, the community based GP with courtesy or associate hospital privileges may bill 13228. If you’re a GP with active hospital privileges at a hospital other than the one where the patient is admitted you can still bill 13228.

On-call On-site Hospital Visits

The following fee codes should be used when you’re currently in the hospital or Emergency Department and are called to see a patient in either the Emergency Department or elsewhere in the hospital.

00113 : On Call, on Site Hospital Visit Evening (between 6:00pm hours and 11:00pm hours)

00105: On Call, on Site Hospital Visit Night (between 11:00pm hours and 8:00am hours)

00123: On Call, on Site Hospital Visit Saturday, Sunday or Statutory Holiday

If you see the patient between weekday working hours, so between 8:00am and 6:00pm, then you’ll bill a visit or procedure fee code.

Reminder: Out-of-office hours premiums are not chargeable in addition to emergency department fees. Claim must state time call placed. All claims need to have the start and end times, with the start time being the time you were called.

Long-Term Care Facility Visits

00114: One or multiple patients, per patient

13334: Community based GP, long term care facility visit – first visit of the day bonus, extra

- Paid only if 00114 is paid on the same day.

- Limit of one payable for the same physician, same day, regardless of the number of long term care facilities attended.

00115: Nursing home visit – one patient.

Use 00115 when you’re called in to see a patient and you see them between 8:00am and 11:00pm. The visit has to take place within 24 hours of the call otherwise you’re not eligible to bill it.

Emergency Visits

When you’re called to the hospital to see a patient urgently during office hours you would bill the emergency visit fee code:

00112 Emergency visit (call placed between hours of 8:00am and 6:00pm) – weekdays

- You can only use 00112 if you must immediately leave where you are to go see the patient. If you’re called to the hospital emergency department while at hospital, bill for an on-call on-site hospital visit or procedure.

- Make sure you add start and end times.

00111: An emergency home (or scene of accident) visit for an acutely ill or injured patient immediately followed by a trip to hospital to arrange for emergency admission and to include immediate associated hospital visit.

Miscellaneous Visits (MAiD GP Fee Codes)

MAiD stands for Medical Assistance in Dying. When billing for MAiD claims you always need to review your patient’s medical records, document the patient encounter (visit) and complete the required Assessor or Prescriber forms (the Assessor Form is the HLTH 1633 form and Prescriber Form is the HLTH 1634 form.

13501: MAiD Assessment Fee – Assessor Prescriber

Includes all requirements of a MAiD assessment including review of medical records, patient encounter and completion of the MAiD Assessment Record (Prescriber).

You can give the assessment in person or by video conference, per 15 minutes or greater portion thereof (less that 15 mins but over 8 mins).

- Maximum payable is 135 minutes (9 units). Services which exceed the maximum will be given independent consideration only if you leave an explanatory note in the MSP note field.

- You must enter the start and end times in both the billing claim and patient’s chart. Additionally, start and end time for the patient encounter must be entered in the patient’s chart.

13502: MAiD Assessment Fee – Assessor

Includes all requirements of a MAiD assessment, including review of medical records, patient encounter and completion of the MAiD Assessment Record (Assessor).

You can give the assessment in person or by video conference, (less that 15 mins but over 8 mins).

- Maximum payable is 105 minutes (7 units). Services which exceed the maximum will be given independent consideration only if you leave an explanatory note in the MSP note field.

- You must enter the start and end times in both the billing claim and patient’s chart. Additionally, start and end time for the patient encounter must be entered in the patient’s chart.

- Not payable with 13501 by same physician.

13503: Physician witness to video conference MAiD Assessment – Patient Encounter

You must be in personal attendance with your patient for the duration of the patient encounter with the Assessor or Assessor Prescriber.

You can only bill for the time spent witnessing the patient – Assessor encounter. 13503 includes the

completion of any required documentation and is for 15 minutes or greater portion thereof (less that 15 mins but over 8 mins).

- Maximum payable is 105 minutes (7 units). Services which exceed the maximum will be given independent consideration only if you leave an explanatory note in the MSP note field.

- You must enter the start and end times in both the billing claim and patient’s chart.

- Not payable with 13501 or 13502 by the same physician.

13504: MAiD Event Preparation and Procedure

- Payable only to Assessor Prescriber.

- 13504 includes all necessary elements: establishment of IV, administration of meds, pronouncement of death.

- It also includes pharmacy visits for procedures provided in facilities with on-site pharmacies.

- You can bill 13505 in addition for procedures provided in facilities with no on-site pharmacy.

- A same day visit fee is payable in full in addition under fee item 00103 (home) or out of office visit fee items 12200, 13200, 15200, 16200, 17200, and 18200 (all other locations).

- Fee items 00108, 13008, 00127 and 00114 are not payable.

13505: MAiD Medication Pick-up and Return

- Paid only in addition to 13504.

- Payable only when MAiD procedure takes place in a location where there is no on-site pharmacy.

- Not payable when time for medication pick-up and return has been compensated under a different payment modality (for example, paid through third party insurance).

13015: HIV/AIDS Primary Care Management – in or out of office – per half hour or major portion thereof (less that 30 mins but over 16 mins).

- When performed in conjunction with a visit, counselling, consultations or complete examinations, only the larger fee is billable.

- You can only use it when using diagnostic codes 042 (HIV Disease), 043 (HIV Infection Causing) and 044 (HIV with Infection).

- Services that are less than 15 minutes duration should be billed under the appropriate visit fee item instead.

- You have to add in the start and end times in both the billing claims and the patient’s chart.

Mental Health Planning & Management

14043 Mental health planning fee

14044 Mental health management fee age 2-49

14045 Mental health management fee age 50-59

14046 Mental health management fee age 60-69

14047 Mental health management fee age 70-79

14048 Mental health management fee age 80+

GP Telehealth Fee Codes

Billing for Telehealth is essentially the same as how you’d submit regular MSP claims, except you select a Telehealth fee code instead of a regular MSP fee code and all Telehealth fee codes are categorized by age.

You can find Telehealth fee codes by quickly searching through our app using the keyword ‘Telehealth.’ Our app syncs with MSP codes so it’s always up-to-date.

Additionally, MSP has introduced temporary billing changes to expand Telehealth services during the pandemic. For an overview of the changes take a look at our COVID-19 billing guide.

Telehealth Consultations

13236: Telehealth GP Consultation (age 0-1)

13436: Telehealth GP Consultation (2-49)

13536: Telehealth GP Consultation (50-59)

13636: Telehealth GP Consultation (60-69)

13736: Telehealth GP Consultation (70-79)

13836: Telehealth GP Visit (80+)

Telehealth Visit Fee Codes

13237: Telehealth GP Visit (age 0-1)

13437: Telehealth GP Visit (2-49)

13537: Telehealth GP Visit (50-59)

13637: Telehealth GP Visit (60-69)

13737: Telehealth GP Visit (70-79)

13837: Telehealth GP Visit (80+)

Telehealth Counselling Fee Codes

13238: Telehealth GP Individual Counselling for a prolonged visit for counselling (age 0-1)

13438: Telehealth GP Individual Counselling for a prolonged visit for counselling (age 2-49)

13538: Telehealth GP Individual Counselling for a prolonged visit for counselling (age 50-59)

13638: Telehealth GP Individual Counselling for a prolonged visit for counselling (age 60-69)

13738: Telehealth GP Individual Counselling for a prolonged visit for counselling (age 70-79)

13838: Telehealth GP Individual Counselling for a prolonged visit for counselling (age 80+)

Counselling Notes:

- MSP will pay up to 4 individual counselling visits (any combination of age appropriate in office or out of office).

- You have to add start and end times need to be recorded on your claim (and in your patients chart).

Telephone Advice & Email

13000: Telephone advice to a Community Health Representative in First Nations Communities

- You can use this fee code for calls if you were called for medical advice from a Community Health Representative.

- You cannot bill it if a Community Health Nurse is available in the Community.

13005: Advice about a patient in Community Care

- You cannot claim 13005 in addition to visits or other services provided on the same day for the same patient with the exception of 14076.

- You can use this fee code for any advice you give via telephone, fax or in written form about a patient in community care. The advice has to have been initiated by an allied health care worker specifically assigned to the care of the patient.

- Community Care comprises Residential, Intermediate and Extended care and includes patients receiving Home Nursing care, Home support or Palliative care at home.

- Allied health care workers are defined as: home care coordinators, nurses, (registered, licensed practical, public health, and psychiatric), psychologists, mental health workers, physiotherapists, occupational therapists, respiratory therapists, social workers, ambulance paramedics, and pharmacists (including completion of faxed medication review with orders, up to twice per calendar year, but not for simple prescription renewal).

- Include the start time on your claim as the time when the advice was received.

- You cannot bill this for advice in response to enquiries from a patient or their family.

- It can be billed to a maximum of one per patient per physician per day.

14018 Urgent telephone conference with a specialist

14022 GP with Specialty Training Tele Patient Management 1 week

14023 GP with Specialty Training Tele Patient Management Follow up

14079 GP Telephone/email Management fee

Pregnancy

14090: Prenatal visit – complete examination

14091: Subsequent examination

- Uncomplicated prenatal care usually includes a complete examination followed by monthly visits to 32 weeks, then visits every second week to 36 weeks, and weekly visits thereafter to delivery. In complicated pregnancies, charges for additional visits will be given independent consideration upon explanation (so remember to leave a note when submitting additional visits).

- When a patient transfers her total on-going uncomplicated prenatal care to another physician,

- the second physician also may charge a complete examination (item 14090) and subsequent examinations, as needed. If you’re the second doctor – make sure you include a note explaining the reason for the transfer.

- Other than during prenatal or postnatal visits, you should charge separately for all visits (including counselling) for conditions unrelated to the pregnancy. If this happens, again make sure to leave a note.

- Other than procedures, services for the care of unrelated conditions, during a prenatal or postnatal visit are included in the prenatal (14091) or postnatal visit fee (14094), and are not to be billed under 04007.

14094: Postnatal office visit

- 14094 may be billed in the 6 weeks following delivery (vaginal or Caesarean Section).

- You cannot claim this if you’re the physician performing the Caesarean Section (usually done the OB). If it’s an emergency c-section the postnatal care is included in the fee code for procedure 14109. If elective, bill 14108.

14199: Management of prolonged second stage of labour, per 30 minutes or major portion thereof.

- This item is billable in addition to the delivery fee only when the second stage of labour exceeds two hours in length.

- Not payable with 04000, 04014, 04017, 04018, or 04085.

- Timing ends when constant personal attendance ends, or at the time of delivery.

- Start and end times must be entered in both the billing claims and the patient’s chart.

14104: Delivery and postnatal care (1-14 days in-hospital)

- Don’t forget to bill for the care of newborn in hospital (00119) if you’re also caring for the newborn.

- If you had to repair the cervix it’s not included in 14104. You’d bill the repair (04502) separately and it’d be paid at 50% when done on the same day as delivery.

- When medically necessary you can bill for additional post-partum office visit under 14094.

14105: Management of labour and transfer to higher level of care facility for delivery

This can also be claimed if you’re the referring physician if you intended to conduct the delivery providing the following conditions are met:

- You attended to the patient during active labour and provided assessment of the progress of labour, both initial and ongoing.

- Active labour is defined as: ”regular painful contractions, occurring at least once in five minutes, lasting at least 40 seconds, accompanied by either spontaneous rupture of the membranes, or full cervical effacement and dilatation of at least two centimetres.”

- There is a documented complication warranting the referral such as foetal distress or dysfunctional labour (failure to progress).

- If you has to transfer the patient to another facility. iii) Not payable with assessment or visit fee or 14104, 14109 and generally 14199 (provide a detailed note if claiming for 14199 in addition).

- OOOHP Continuing Care Surcharges do not apply to maternity services in the first stage of labour only.

- When medically necessary you can bill for additional post-partum office visit under 14094.

14108: Postnatal care after elective caesarean section (1-14 days in-hospital)

14109: Primary management of labour and attendance at delivery and postnatal care associated with emergency caesarean section (1-14 days in hospital)

- Surgical assistant isn’t included and you can bill extra for this.

- When medically necessary you can bill for additional post-partum office visit under 14094.

14545: Medical abortion

- Includes all associated services provided on the same day as the abortion, including the consultation whenever given, required components of Rh factor, associated services including counselling rendered on the day of the procedure, and any medically necessary clinical imaging.

15120 Pregnancy test, immunologic – urine

14004 Full service gp-obstet delivery bonus-w delivery

14005 Full service gp-bonus with transfer higher care

14008 Full service gp-bonus with post natal care

14009 Full service gp-obstet delivery bonus-w c section

Gynecology

14540: Insertion of intrauterine contraceptive device (operation only – it includes Pap smear if required).

14541: Removal of intrauterine device (IUD) -operation only

14560: Routine pelvic examination including Papanicolaou smear (no charge when done as a pre and postnatal service)

Services billed under this code must include both a pelvic examination and Pap smear (14560).

Infant Care

00118: Attendance at caesarian section (if specifically requested by surgeon for care of baby only)

- Not payable if a paediatrician is present at the caesarean section to care for the baby.

00119: Routine care of newborn in hospital

Urology

13655 GP vasectomy bonus associated with bilateral vasectomy

- Maximum of 25 bonuses per calendar year

- Payable only when fee item 08345 billed in conjunction

- You can only bill this bonus once per vasectomy/per patient.

Surgical Assistance

13194: First Surgical Assist of the Day

Surgical Assistance fee codes:

00195: less than $317.00 inclusive

00196: $317.01 to 529.00 inclusive

00197: over $529.00

00198: Time, after 3 hours of continuous surgical assistance for one patient, each 15 minutes or fraction thereof (at least 8 minutes).

- In those rare situations where an assistant is required for minor surgery then make sure the surgeon notes it in their planning/charting/OR report.

- If you assist at two operations in different areas performed by the same or different surgeon(s) under one anesthetic, you may charge a separate assistant fee for each operation, except for bilateral procedures, procedures within the same body cavity or procedures on the same limb.

- Visit fees are not payable with surgical assistance on the same day, unless each service is performed at a distinct/separate time. If this is the case make sure you leave start and end times on all your claims to prove they took place at various times.

00193: Non-CVT-certified surgical assistance at open-heart surgery, per quarter hour or major portion thereof

- The same fee applies equally to all assistants (first, second, etc.).

- Start and end times must be entered in both the billing claims and the patient’s chart.

Anesthesia

13052: Anesthetic evaluation – non-certified anesthesiologist

Minor Procedures Performed by GP

00190: Forms of treatment other than excision, X-ray, or Grenz ray; such as removal of haemangiomas and warts with electrosurgery, cryotherapy, etc.- per visit (operation only)

- You can claim this only if you not a dermatologist.

- The treatment of benign skin lesions for cosmetic reasons, including common warts (verrucae) is not covered by MSP.

13660: Metatarsal bone – closed reduction (operation only)

13600: Biopsy of skin or mucosa (operation only)

13601: Biopsy of facial area (operation only)

- Punch or shave biopsies which do not require sutures are not to be charged under fee items 13600 or 13601.

13605: Opening superficial abscess, including furuncle – operation only

13610: Minor laceration or foreign body – not requiring anesthesia – operation only

- Intended for primary treatment of injury.

- You can’t claim this for dressing changes or removal of sutures.

- Applicable for steri-strips or glue to repair a primary laceration.

13611: Minor laceration or foreign body – requiring anesthesia – operation only

13612: Extensive laceration greater than 5 cm (maximum charge 35 cm) – operation only – per cm

13620: Excision of tumour of skin or subcutaneous tissue or small scar under local anesthetic – up to 5 cm (operation only)

13621: additional lesions removed at the same sitting (maximum per sitting, five) each (operation only)

- The treatment of benign skin lesions for cosmetic reasons, including common warts (verrucae) is not covered by MSP.

13623: Excision of tumour of skin or subcutaneous tissue or small scar under local anesthetic – face (operation only)

13624 Removal of extensive scars – 5 cm or more – per cm over 5 cm (in addition to 13623 or 13620)

- Payment for scar revision is based on length of scar, not length of incision.

- Make sure you leave a note in the MSP note field for any scars that are greater than 30cm.

13622: Localized carcinoma of skin proven histopathologically (operation only)

13630: Paronychia – operation only

13631: Removal of nail – simple operation only

13632: with destruction of nail bed (operation only)

13633: Wedge excision of one nail (operation only)

13650: Enucleation or excision of external thrombotic hemorrhoid (operation only)

10710: In office Anoscopy

- Use this for evaluating patients with anal and/or peri-anal symptoms (pain or bleeding), or used as an adjunct to the DRE.

- Not payable in addition to 00715, 00716, 00718, 10714, 10731, 10732 or 10733.

Tests Performed in a Physician’s Office

The following tests are only payable when performed in your office. These tests are not payable to laboratories, vested interest laboratories and/or hospitals.

00012: Venepuncture and dispatch of specimen to an approved laboratory facility, when no other blood work performed

- This is the only fee code available for taking blood specimens. You can only use it when a single bloodwork service is needed.

- You can only claim 00012 if after taking the test you send it to another physician’s office or a laboratory (i.e., only when you do not perform another laboratory procedure using blood collected at the same time.

- When billed with another service, such as an office visit, 00012 may be billed at 100%.

15132: Candida Culture

15133: Examination for eosinophils in secretions, excretions and other body fluids

15134: Examination for pinworm ova

15136: Fungus, direct microscopic examination, KOH preparation

15100: Glucose – semiquantitative (dipstick analysed visually or by reflectance meter)

15137: Hemoglobin cyanmethemoglobin method and/or haematocrit

15000: Hemoglobin – other methods

15110: Occult blood – feces (applies only to guaiac methods).

15120: Pregnancy test, immunologic – urine

30015: Secretion smear for eosinophils

15138: Sedimentation rate

15139: Sperm, Seminal examination for presence or absence

15140: Stained smear

15141: Trichomonas and/or Candida and/or Bacterial Vaginosis direct microscopic examination

15130: Urinalysis – Chemical or any part of (screening)

15131: Urinalysis – Microscopic examination of centrifuged deposit

15142: Urinalysis – Complete diagnostic, semi-quant and micro

15143: White cell count only (see the Laboratory Services Payment Schedule for additional information)

The following test is payable in a physician’s office (when performed on their own patients) and/or on a referral basis:

93120 E.C.G. tracing, without interpretation, (technical fee)

Investigation

00117: Interpretation of electrocardiogram by non-internist

No Charge Referral

03333: Use this code when submitting a claim for a “no charge referral.” This code is submitted to MSP when you are sending a patient to a specialist for consultation but not submitting a claim for the referral.

Operative Surcharges

Operative surcharges are percentage based premiums that are billed in addition to any surgical procedure. As a GP you’re eligible to bill for any surgical procedures that aren’t restricted to a specific specialty.

You can add the Operative surcharges for emergency surgery or elective surgery that were bumped by an emergent surgery resulting in the elective surgery to be completed during out of office hours.

You can only claim them for surgeries that require general, spinal or epidural anesthesia and/or lasting at least 45 minutes.

- 01210: Evening (6:00pm to 11:00pm) – 42.86% of surgical (or assistant) fee

- 01211: Night (11:00pm to 8:00am) – 72.02% of surgical (or assistant) fee

- 01212: Saturday, Sunday or Statutory Holiday (Service rendered between 8:00am and 11:00pm) – 44.86% of surgical (or assistant) fee

Final Takeaway:

Remember you have the option of “starring” your most commonly used billing codes. That way, they’ll appear at the top for searching.

This article offers general information only and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Ventures Inc. or its affiliates.