The key role of clinic and hospital financial management in Canada is managing resources and reducing risk to achieve a healthcare organization’s goals. It involves navigating strict regulatory standards, intricate financial systems and a complex billing structure. These challenges, combined with the need for consistent revenue cycle management and robust security, mean that effective, accurate and timely accounting and financial reporting is essential.

This guide explores common financial management challenges, provides actionable solutions and highlights three key areas essential for effective accounting, reporting and revenue cycle management in Canadian healthcare settings.

1. Financial Reporting Requirements

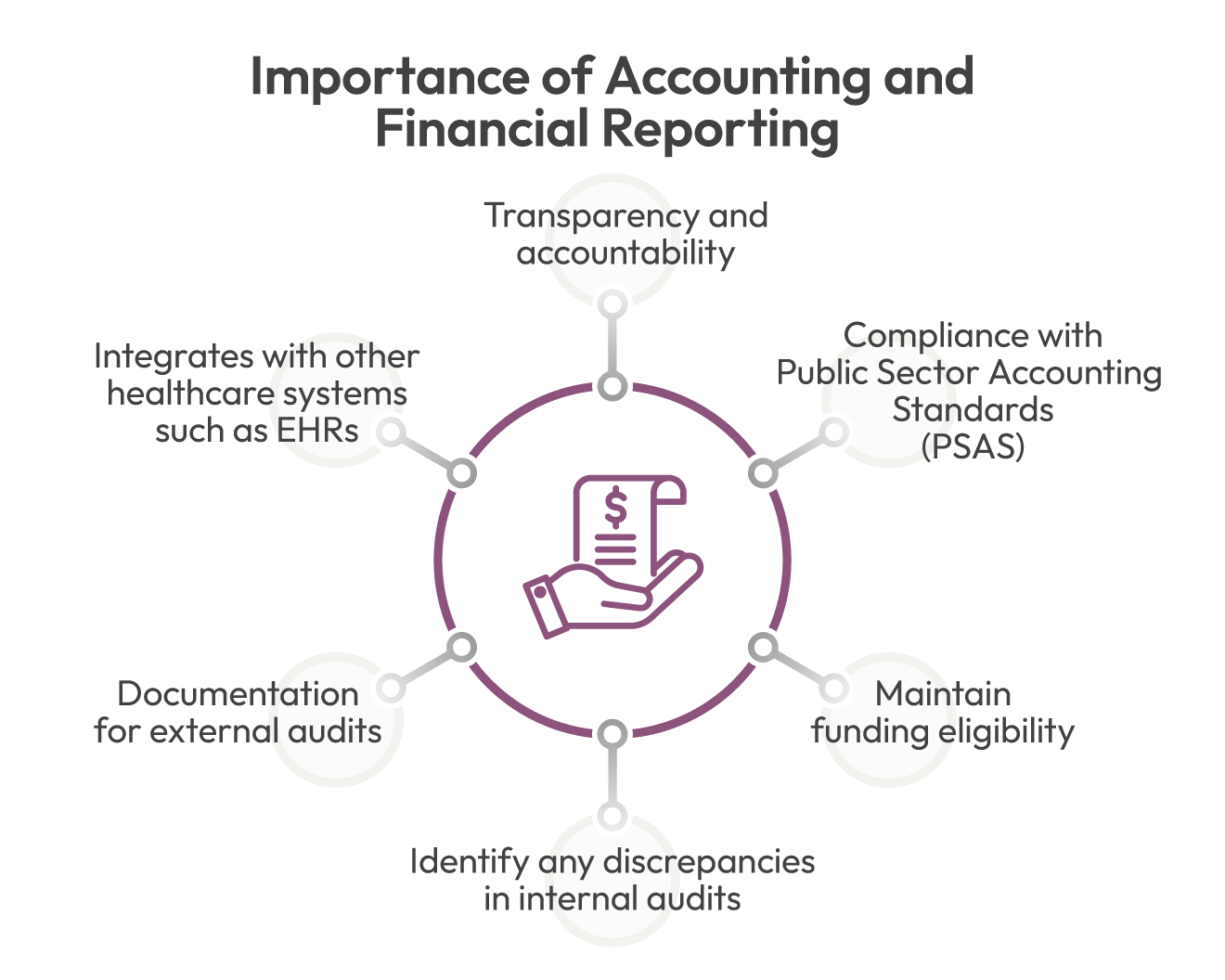

Hospital departments and clinics in Canada must meet various financial reporting requirements to ensure transparency, compliance and accountability. These obligations are complex and are subject to evolving accounting guidelines, with regular updates needed for stakeholders, government regulatory bodies and audits.

Monthly and Annual Reporting Requirements for Stakeholders

Hospitals and clinics in Canada are accountable to many stakeholders, including donors, investors and boards of directors. To keep stakeholders informed of the healthcare facility’s financial health, accurate monthly and annual reporting is essential.

- Challenge: Monthly and annual reporting can be time-consuming and prone to inconsistencies due to manual data entry, errors or delays.

- Solution: Implement an integrated financial management system to automate data collection and reconciliation across departments, ensuring uniformity and accuracy. Establish standard operating procedures (SOPs) for data entry, review and approval, which can streamline the process and minimize errors. Dr.Bill Group Solutions, for example, have robust reporting functionality where groups can generate reports and filter by MOH group, claim status, start and end dates of service, and more.

Government Reporting

Canadian hospitals and clinics are required to provide detailed financial disclosures to government agencies to ensure compliance and to maintain funding eligibility. Government reporting requires healthcare organizations to follow Public Sector Accounting Standards (PSAS), which come with a unique set of requirements for accounting and financial reporting.

- Challenge: Accurately tracking government grants, funding and expenditures to meet compliance requirements.

- Solution: Regular audits within the finance team can help identify discrepancies before official reporting deadlines. Healthcare organizations may also consider implementing a software platform that categorizes and tracks government funds according to PSAS requirements.

Potential for Audits

Healthcare organizations in Canada are subject to both internal and external audits. Government audits tend me be rigorous, requiring documentation and scrutinizing every applicable detail of various financial transactions.

- Challenge: Inconsistent or incomplete transaction documentation can lead to audit failures, risking penalties or potential funding losses in the future.

- Solution: Engage a document management system that securely organizes and stores records, making them easily accessible during audits. Conduct regular internal audits to identify and rectify potential issues that may occur ahead of an external audit.

With the appropriate tools and technology, a medical practice can reduce audit issues, lower costs, improve its productivity and enhance the patient experience.

Some essential technology tools include:

Electronic Health Records (EHR) – EHRs allow a healthcare provider to follow up with patients regarding appointments, medication reminders and send test results by email or phone. Less paperwork translates to fewer errors, more free time, and better resource utilization.

Auditing – Billing software is an essential tool to maintaining the financial health of hospitals and clinics. Products like Dr.Bill Group Solutions enable institutions to track and store claims to help simplify organization in the event of audit, while also making it easy to get paid for all the work that a medical practice does.

Practice Management Software – There are systems that are capable of handling appointment scheduling, EHR management, billing and more. However, the drawback is the software may excel in some areas and lack robustness in other features.

2. Revenue Cycle Management

Revenue cycle management (RCM) is critical to healthcare financial management. It is used by hospitals and clinics to bill, track and collect payments. RCM encompasses the entire process of capturing patient revenue, from initial patient registration through to claims submission and payment collection.

Billing – Public, Alternative Funding and Private

Canadian healthcare providers handle a variety of billing types, including public healthcare (covered by provincial healthcare plans), alternative funding sources (e.g., government or private grants and partnerships) and private insurance billing.

- Challenge: Differences in billing requirements across public and private sectors can lead to errors or billing discrepancies that may delay payment.

- Solution: Utilize billing software that integrates with the practice’s electronic health records (EHR) to streamline data transfer and reduce manual entry errors. Choose a software that can also standardize billing codes and help staff match each service with the appropriate billing category.

Rejection and Reconciliation

Managing rejected claims and ensuring reconciliation of all accounts is a significant part of revenue cycle management.

- Challenge: High rejection rates can hinder cash flow, particularly if claims are rejected due to avoidable issues like incorrect billing codes.

- Solution: Review and update coding standards regularly to prevent common errors. Train billing staff to recognize and correct these issues promptly. For reconciliation, establish a systematic review process to ensure accounts align with the corresponding payments and insurance claims. In addition, there are systems exclusive for groups and organizations that manage billing from end-to-end, from submitting claims and resubmitting rejections to reviewing payments and running reports.

Budgets, Financial Statements and Cash Flow

Creating a yearly budget with regular check-ins is a key component of revenue cycle management. It supports the practice’s business plan and helps form the strategy and action plan for the clinic or hospital to succeed by providing a clear financial picture of where the organization stands now and where it is expected to be in the coming year.

Structured planning can make all the difference in the growth and success of a clinic or hospital. A budget controls the finances of the practice by ensuring it can fulfil its current commitments, meet its near-term objectives and has funds for future projects, such as upgrading equipment and hiring staff.

A medical practice’s financial statements provide insight into its financial health. Reviewing the balance sheet, income statement and cash flow statement each month can help keep tabs on receivables, payables, revenues and expenses.

The ability to manage cash flow is also fundamental to the financial health of healthcare facilities. Dr.Bill’s solution for clinics and hospitals across Ontario, British Columbia and Alberta can help optimize cash flow through regular monitoring, forecasting and reconciliation with accounting. Frequent monitoring helps drive decision making as it relates to receivables, payables and inventory.

Monitoring outstanding receivables will help eliminate surprises, keep funds coming in and take action on balances that are past their due dates. Organize and prioritize payables to maintain as healthy a cash position as possible. Increasing the frequency of inventory counts help understand what materials are running low so they can be reordered faster.

3. Technology and Accounting

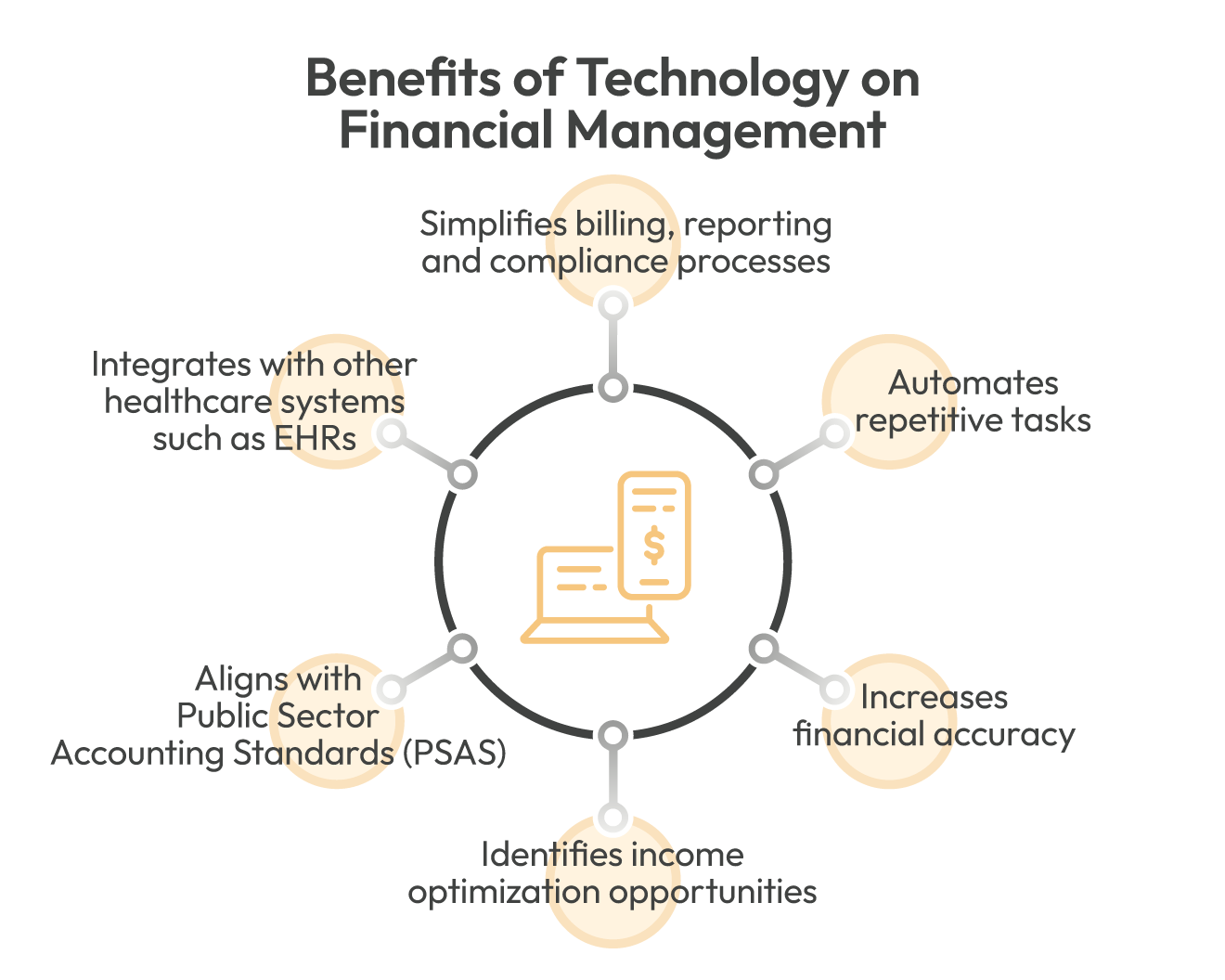

With digital transformation accelerating across the healthcare sector, Canadian hospitals and clinics increasingly rely on technology to optimize financial management processes.

General Accepted Accounting Principles (GAAP) and Requirements in Accordance with Government Standards (PSAS)

Canadian healthcare facilities follow Public Sector Accounting Standards (PSAS) to ensure consistency and transparency in financial reporting. PSAS compliance is crucial to maintain funding eligibility and avoid penalties.

- Challenge: Aligning with PSAS without specialized accounting resources can be challenging for many medical clinics and hospitals.

- Solution: Hire an accounting firm familiar with PSAS or engage an accounting professional who can provide periodic guidance. Implement accounting software that complies with PSAS standards to maintain compliance, minimize errors and streamline processes.

Financial Management Software

Financial software tailored to hospital departments and clinics in Canada simplifies billing, reporting and compliance processes.

- Challenge: Outdated or incompatible software can create reporting inefficiencies and affect financial accuracy.

- Solution: Invest in financial software that aligns with PSAS, integrates with other healthcare systems and automates repetitive tasks, which frees up time for finance staff to focus on value-added work such as planning and forecasting.

Modern billing platforms such as Dr.Bill Group Solutions make medical billing faster, easier and more accurate for medical groups of many sizes—from two to more than 200. while delivering visibility with key reports and insights. Key benefits include revenue management, role-specific permissions, cross-institution functionality, integration with EHR systems and bank-level security.

From automating repetitive tasks and supply chain management to telemedicine and optimizing staffing resources, the employment of technology in hospital departments and clinics can improve processes, enhance patient outcomes and reduce the costs to deliver healthcare.

In Conclusion

Effective financial management that steers healthcare organizations through rigorous reporting regulations, and a complex billing structure is essential for the long-term success of hospitals and clinics in Canada. By embracing sound revenue cycle management, addressing common billing challenges and leveraging technology to enhance accounting accuracy, healthcare facilities can ensure they are compliant, efficient and financially sound.