This article was originally published by RBC Healthcare.

Many of us may have a tendency to isolate education as something that's primarily limited to the formal schooling years. But with financial education, the reality is that it can and should be an ongoing process, and it's never too early or too late to start.

A snapshot of financial learning

According to recent survey findings from Phoenix Marketing International, among Canadian respondents (across a variety of age ranges), the top three financial management topics identified as important for younger generations to know about are financial planning, saving and budgeting, and investing. Furthermore, almost half of respondents felt that educating their family about financial topics is “very important."1

Interestingly, however, in that same survey, when it comes to personal financial education, only 16 percent of respondents identified it as a priority for themselves.2 In other words, while many individuals and families place a high level of importance on building financial literacy among youth and younger generations, many may be overlooking the benefits and importance of their own financial knowledge and its value throughout every life stage.

Using your life stage as a catalyst for learning

Within each broad phase of life, there are generally some main milestones or areas of focus that commonly impact financial priorities and planning during those years and that will contribute to your overall financial picture as well. Depending on your current comfort level and familiarity with financial topics and your particular circumstances, it may be beneficial to use your current life stage as a driver for the type of learning you want to pursue.

In general, there are three main wealth stages individuals move through and between over the course of life:

| Stage | Description | Main objectives |

|---|---|---|

| Early savers | - Getting established in a career, perhaps buying a home, getting married or starting a family | - Earning and saving - Growing assets |

| Mid-life accumulators | - Have a stable career, are a homeowner - Starting to think about retirement and estate planning and transferring wealth to the next generation | - Creating a balanced portfolio for preservation and growth - Maximizing savings where possible - Focusing on retirement goals and short- and long-term intentions for wealth transfer |

| Preservers/spenders | - Retired or working less - Using accumulated wealth to generate income as a salary replacement - Estate and wealth transfer planning is a priority | - Protecting assets and making it last through the senior years - Minimizing risk - Managing wealth wisely in regards to income tax |

With these details in mind, here are some financial planning tips based on your wealth stage:

If you're an early saver…

- Think about and record your short- and long-term financial goals, big and small.

- Establish a budget that factors in all of your lifestyle expenses and other financial components.

- Consider setting up a pre-authorized savings plan to help prioritize your savings.

If you're a mid-life accumulator…

- Review your short- and long-term goals to ensure your financial vision is matched with the right investments.

- See where you may be able to increase your savings in RRSPs, TFSAs or RESPs; in general, try to make your retirement savings a priority and maximize your contributions where possible.

- Ensure you have the appropriate mix of investments to build your savings within your projected time horizon before retirement.

- Turn a focus to estate planning, including a Will and Power(s) of Attorney (called a Mandate in Quebec), and start giving thought to your preferences and intentions for transferring wealth.

If you're a preserver/spender…

- Revisit your financial plans to explore the options in structuring your finances to support your retirement lifestyle.

- Consider the potential for senior care or other healthcare-related needs and how those costs may impact your overall financial picture or your wealth transfer intentions.

- Take the time to review your estate plans and carry out any further planning as needed. If you haven't done so already, work on building an inventory of all of your assets.

Need some help with your financial planning? Talk with a dedicated RBC Healthcare Specialists and see how they can help.

1 Wealth-Affluent Monitor-Canada. Spring/Summer 2019 key findings and proprietary data reports in partnership with RBC Wealth Management. Phoenix Marketing International. July 2019.

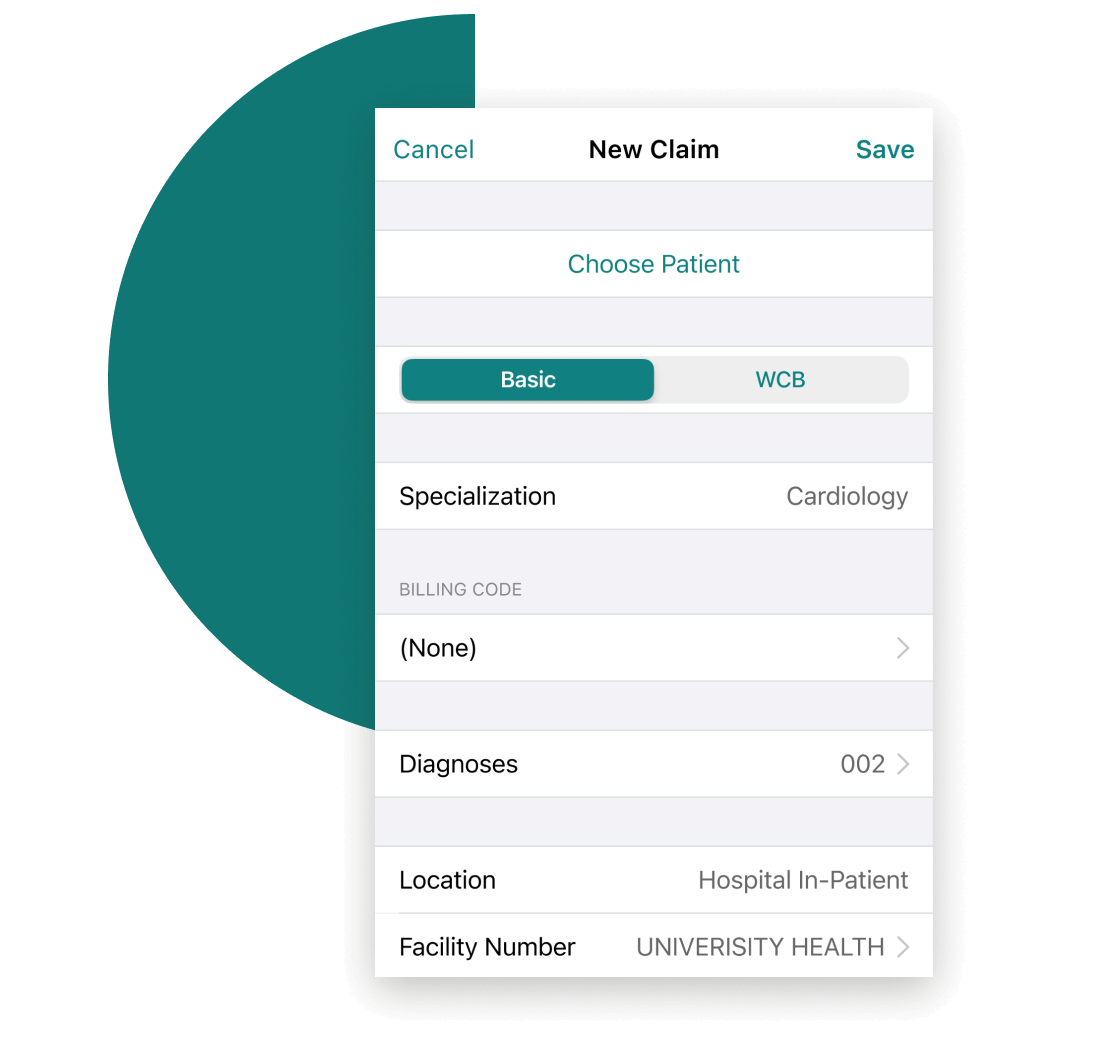

Solutions Designed For The Unique Needs Of Your Practice

Get a $150 Credit when you sign up for Dr.Bill*. No credit card required.