Having your MSP claims rejected can be a costly and time-consuming process – but there are plenty of doctors who have been in your shoes. Many of the most commonly made mistakes are also avoidable. Here are some examples of common billing mistakes that will end up getting your claim rejected, and the best ways to fix them:

Rejection: Incorrect Diagnosis Code

Diagnosis codes are important, but it’s easy to make mistakes that can lead to rejection. For example, billing a minor procedure for a patient on the same day as you have a visit is acceptable, but if the diagnosis code is the same for both the visit and the procedure, only the lesser fee code will be paid at 50%. In this case, if you saw your patient for different reasons and had two separate diagnoses, then using two different codes would ensure you are paid in full.

Rejection: Out of Office Premium

Out of office premiums add extra income to your bottom line each month, but they can also mean extra chances for rejection. Call-outs and continuing care premiums have their own set of rules attached – for example, if you try to bill a continuing care premium without first billing a call-out code, your claim will be rejected.

Remember that these premiums are meant to be used on an urgent, non-elective basis when you get called to the hospital to see a patient – you bill the initial call- with codes (01200, 01201, 01202). If you remain at the hospital afterwards, you can bill for continuing care. Since continuing care claims are based on you coming into the hospital for a call-out, they will not be paid until your Call Out premiums are paid. If you have any issues with your call-out claim, the subsequent continuing care premium will be refused. Get into the habit of double-checking your call-out claim is correct and not missing details (like a referring physician or start and end times).

If you forget to add a call-out premium before billing your continuing care claim, you can just change the order and re-bill.

Rejection: No Patient Insurance

Claims that come back as rejected for lack of MSP coverage are tough to fix, especially if you weren’t aware of the patient’s insurance status ahead of time – but there are a couple options. One is to notify the patient that their coverage is expired or outdated. If it’s expired, your patient will have to call MSP and ask them to back-date their coverage. Keep in mind that in this case, it’s your patient who will have to make the phone call, as your office does not have the authorization to do so. Your other option is to reissue the claim as private, so your patient (or their insurer) can pay it.

Rejection: Using Directive Care Codes 3+ Times in a Week

You can use directive care codes when you are not the most responsible physician. Since they’re meant to be used when you’re called on for your expertise and brought in to help a patient, they pay more than regular hospital visit codes. However, these same reasons are why you can only claim a maximum of 2 directive care codes per patient per week. If you expect to see the patient more than this, it’s better to bill a hospital visit, which can be billed daily. If you already billed your 2 directive care codes and then need to see a patient for a third time in the week, you can leave a note in the MSP notes section of your claim explaining why, then try to resubmit.

Claims on Hold

Held claims are claims that will be processed manually by someone from the MSP claims office. The reason why some claims get held for manual processing while others go through automatically is unknown, but claims that do end up held are supposed to be released within 30 days. Depending on MSPs volume and staffing, it can often be longer – and you won’t know why your claim is on hold until it’s finished processing.

Rejections You Can’t Recover

While many rejections can be fixed and resubmitted, there are some you simply can’t fix – so it’s a good idea to avoid making these kinds of mistakes if possible. These include:

- Claims paid to another physician: MSP will not pay you for an identical claim that has already been submitted by another doctor (for example, the same patient, fee codes, etc.). In this case, you won’t be eligible for reimbursement – generally, whoever submitted the claim first is the one who will get paid.

- Wrong Diagnostic Family: there are some codes that can only be billed with a specific diagnosis. For example, billing code 14051 (chronic care – heart failure) with a diagnosis code of 401 (essential hypertension) will be rejected, because it requires the ICD-9 code for heart failure (428). Diagnostic code descriptions (ICD-9) can be found here.

- Second Rejection: if you’ve already resubmitted a rejection claim with an explanation but MSP still rejects it, you can’t submit it again. Unfortunately, this one will be unrecoverable.

- Exceeded Limit for Claim: each fee code comes with its own set of rules, and breaking one can end up getting your claim rejected. For example, if you try to bill 14033 for the second time in a year, it will be turned down as it’s use is limited to once per year, per patient. The same goes for billing 14077 for 3 units per day, when you’re only allowed 2.

- Double Billing: sometimes services that you try to claim are already included in another billed item, such as a consultation or surgical procedure. For example, billing 10004 (spec multidisciplinary conferencing for complex pt) when you’ve already billed 78717 (specialist discharge care plan for complex patient) would be rejected, because 78717 includes a meeting to discuss the medical management plan with your patient – trying to bill these codes together would be charging for that time twice.

- Non-Benefit in Certain Locations: some fees, such as tray fees (00044) cannot be billed when the service is performed at a funded facility, like a hospital, diagnostic and treatment centre, or psychiatric institution – these fees are included as part of the patient’s stay, so billing for them would be a duplicate charge.

If you’ve made any of these mistakes, don’t worry! Rejections happen, and you can expect to see your fair share, especially as a new physician. The best way to prevent them from happening in the future is to learn from your mistakes. Errors from MSP will be accompanied by an error code and a description of what the code means. Spending some time going through your claim reports each month and looking up the descriptions for your errors with a tool like our searchable database is a great way to keep on top of your income and save time on billing in the future.

This article offers general information only and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Ventures Inc. or its affiliates.

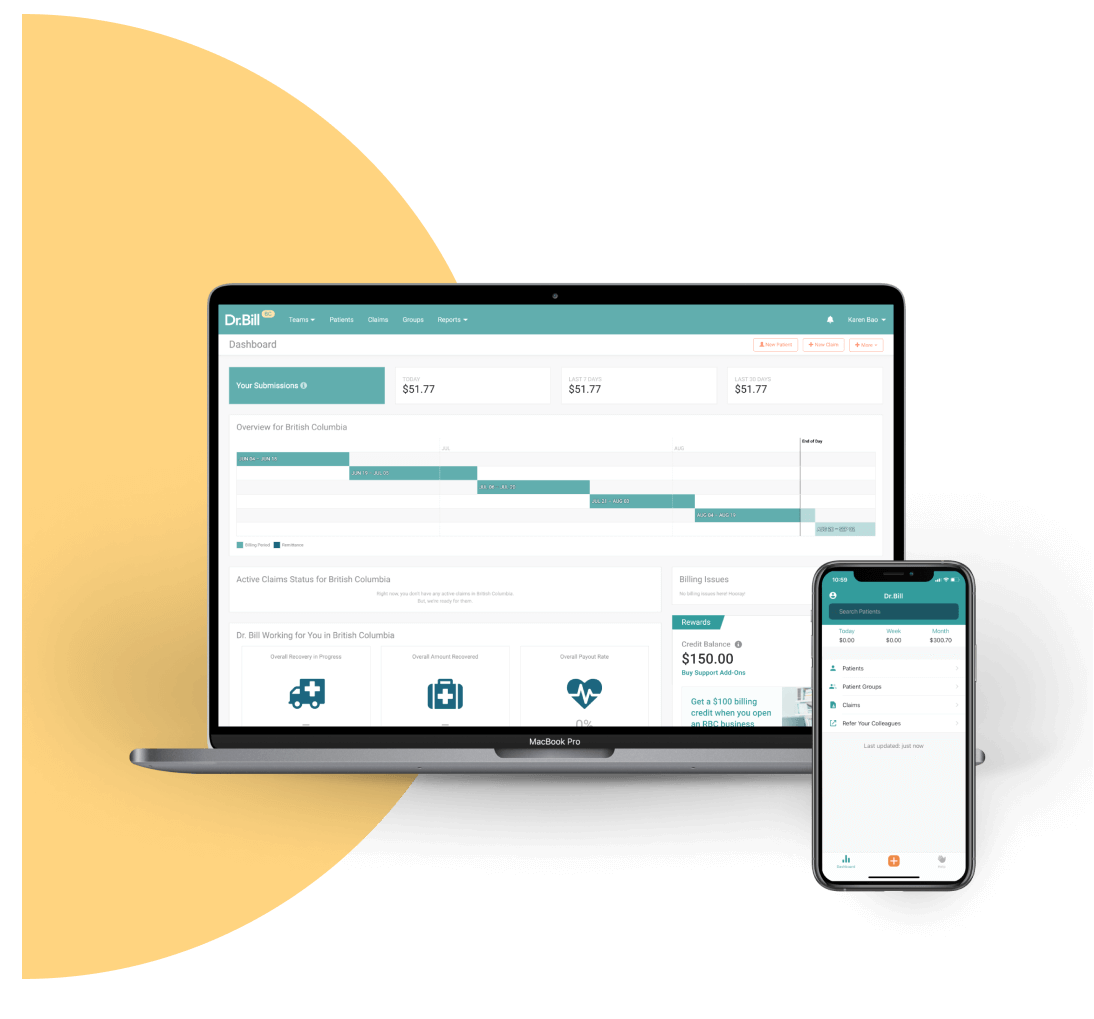

An MSP Expert in your Pocket

Find codes and bill premiums with a tap. Get a $150 Credit when you sign up for Dr.Bill*.