As a physician or medical learner, understanding the intricacies of physician payment models is not just a matter of financial interest, but a key aspect of your career. These models play a fundamental role in shaping the dynamics of your medical practice, from the services you provide to the financial stability you enjoy.

From traditional fee-for-service to innovative alternative payment models, this article delves into the complexities of physician payment models in Canada: how they operate, the trends shaping their adoption and the pros and cons of each.

Fee-For-Service (FFS)

Fee-for-service is the most traditional and widely recognized physician payment model in Canada with 96% of physicians receiving at least a portion of their earnings this way.

How Fee-For-Service Works

At its core, FFS is a simple concept:

- See a patient

- Submit a bill (claim) for what you did

- Receive payment if the claim is approved

Most fee-for-service claims are submitted to your provincial Ministry of Health, though some invoices may be submitted elsewhere, such as to the provincial Workers Compensation Board, a private insurance company or the individual patient.

While fee-for-service works in a similar way across the country, each province has a different list of services and fees. These lists are extensive, such as the approximately 500-page MSC Payment Schedule in BC and almost 1,000-page Schedule of Benefits in Ontario. Additionally, these Schedules come with many guidelines and exceptions, making the simple concept of FFS somewhat more complex in practice.

The challenges of billing fee-for-service vary widely depending on your specialty and practice setting. For instance, physicians who do rounds may enjoy faster and more routine billing while general surgeons typically have complex billing.

With fee-for-service, meticulous record-keeping is essential and it is critical for charts and records to match claims submitted, especially in the case of an audit.

Pros and Cons of Fee-For-Service

While fee-for-service may be the most common payment method, its merits are a common source of debate, with the most frequent criticism being that it is a quantity-based model that doesn’t adequately remunerate quality care:

| Pros | Cons |

|---|---|

| Physicians maintain autonomy over work quantities | Discourages physicians to pursue practices with lower volumes or those with patients requiring complex care, potentially resulting in inequitable care |

| The fundamentals of the model are easy for both physicians and the general public to understand | Billing can be time-consuming, leaving less time for patient care |

| Provides incentives for physicians to see more patients | Rewards speed over quality of care |

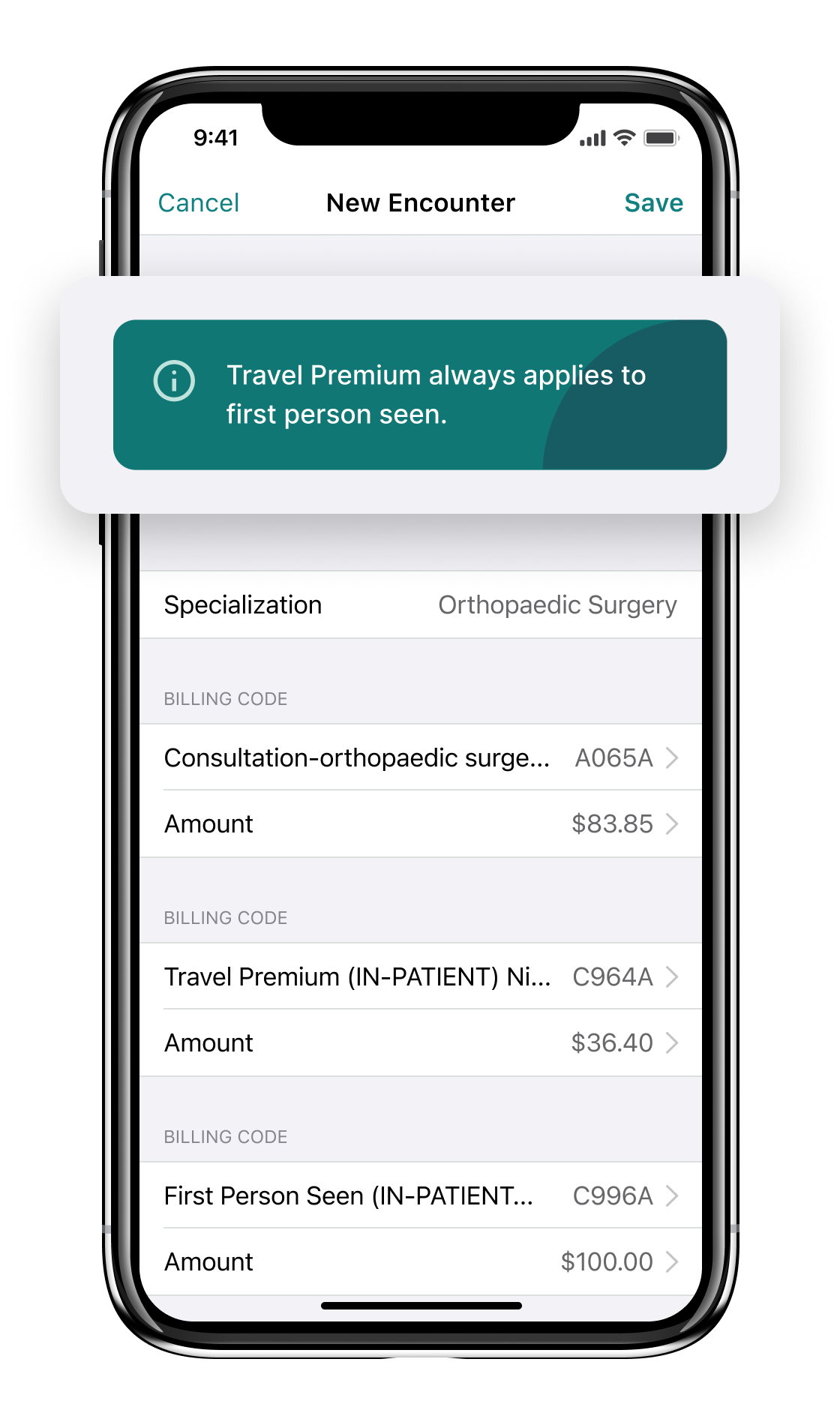

Fee-For-Service Billing Example

Below is an example of a fee-for-service claim an Orthopaedic Surgeon might submit in Ontario for a consult (code A065) plus a special visit premium for being on call (code C996):

Alternative Payment Models (APMs)

It’s increasingly likely for physicians to encounter APMs as provinces continue to implement a wide range of models to address physician concerns and the limitations of fee-for-service. However, for tracking purposes, doctors on alternative payment models will typically still submit claims as though they are on fee-for-service (shadow billing). Claims may also be submitted for full fee-for-service payment when the claim is for an “out of basket” service (a service not covered by the APM).

What is Shadow Billing?

Physicians on alternative payment models are still often required to submit “claims” as though they are on the fee-for-service model. This allows the provincial Ministry of Health to track healthcare service delivery.

However, because shadow billing physicians are being compensated through an alternative payment model, shadow billed claims are either not paid at all or paid at a lower percentage of the FFS rate (depending on the physician’s agreement).

How Alternative Payment Models Work

Alternative payment models vary widely, but are generally made up of a combination of two or more of the following:

- Fees for clinical services

- Time-based payments

- Rewards for participation in specific clinical initiatives

- Incentives for working in underserved communities (e.g., rural/remote areas)

- Population or capitation payments (payments per rostered patient regardless of how much the patient is seen)

- Payment for admin costs

- Bonuses for achieving specific targets

Alternative Payment Model Pros and Cons

| Pros | Cons |

|---|---|

| Predictable income regardless of patient volume or complexity | Contract re-negotiations may add administrative complexity |

| Compensation for indirect care activities such as charting, prescription renewals and admin | Contracts may place limits on certain types of services (e.g. % of additional FFS work), reducing physician autonomy |

| Physicians can spend more time on complex patients, preventative care priorities, etc. | Compensation inequity can still exist in some situations (e.g., a capitation model where a high volume of patients are complex or become complex over time) |

Alternative Payment Model Example

A wide variety of APMs exists across Canada and are sometimes customized down to the clinic or individual physician level. This example, however, illustrates a broadly implemented alternative model with high adoption:

The Longitudinal Family Physician (LFP) Payment Model

How it compensates physicians:

In 2023, MSP introduced the LFP payment model in BC as an alternative to fee-for-service for primary care physicians. This model offers a combination of:

- Payments for direct and indirect patient care

- Time-based and interaction-based payments

- Payments for administrative work

- Payments for patient roster size/complexity

Adoption:

In less than one year, 3,600 family physicians (of the 6,200 in BC) signed up for the LFP model.

Benefits:

- More equitable and predictable overall compensation for family physicians with an estimated $385,000 average salary (vs. approximately $250,000 on FFS)

- Compensation for indirect care activities

- More time with patients

- Compensation for time/complexity

- Simpler billing with just 11 codes

Salary

True salaries are the rarest form of payment for physicians, with some categorizing salary as simply another alternative payment method.

How Salaries Work in Medicine

Resident physicians receive a salary and typically transition to sole proprietorship or incorporation once they transition to independent practice.

In general, only a small number of practising physicians work under a “traditional” salary model with health benefits, vacation time and other common employee compensation package components. You are most likely to encounter salaries in academic, administrative and government roles where fee-for-service and alternative payment models are a poor fit for the type of work being executed.

It’s common to hear colleagues refer to other types of payments as a “salary,” such as sessional payments or fixed service contracts. The difference is that with a true salary, you are an employee whereas with other types of salary-like structures, you can typically still take advantage of the benefits of incorporation or sole proprietorship.

Salary Model Pros and Cons

| Pros | Cons |

|---|---|

| Predictable income | Salaries may not provide the same level of income as FFS or APMs (very dependent on negotiations) |

| Better work/life balance | Physicians may sacrifice some autonomy (e.g., priorities, responsibilities) as an employee |

| Less financial complexity with no need to bill or run a business | Self-employed physicians benefit from significant tax deductions and potential advantages not available to traditionally employed physicians |

Advice for Salaried Physicians

As a salaried physician, you may be able to work around some of the “cons” of this model by:

- Negotiating with your employer to reimburse relevant expenses (e.g. association dues, malpractice insurance) as a benefit.

- Doing fee-for-service or other work on the side so that you can earn a business income and take partial advantage of the benefits of self-employment.

- Staying up to date with fee-for-service compensation averages in your province so that you can negotiate a comparable salary.

Trends in Physician Payment Models

For physicians and resident physicians, staying informed about the trends and shifts in physician compensation is crucial. In recent years, there has been a shift as Canada’s healthcare system strives to adapt to new challenges and priorities:

Increase in Alternative Payment Models

Alternative payment models are gradually becoming complements to (and sometimes even replacements for) fee-for service in an effort to improve the quality of care, enhance patient outcomes and remunerate physicians fairly and equitably. In fact, 64% of Canadian physicians now receive some form of payment through APMs.

With greater incentives for preventative and complex care, APMs can help physicians stay more aligned with the core reasons they became a doctor in the first place.

Value-Based Healthcare

The concept of value-based healthcare (VBHC) is gaining traction not just in Canada, but worldwide. This approach emphasizes healthcare quality and outcomes over quantity care. Discussions surrounding value-based healthcare may increasingly influence alternative payment models to some degree, rewarding healthcare providers for delivering high-value care that meets patient needs at an efficient cost. Some ways this may present is through incentives to improve outcomes or to work in teams that incorporate complementary healthcare professionals.

Innovations in Care Delivery

Technological advancements such as telemedicine, digital health records, interoperability, remote monitoring and AI are enhancing healthcare in Canada. These technologies empower physicians to provide care more efficiently, improving patient access and engagement. It is plausible that payment models will evolve to recognize and incentivize the use of proven technologies and aggregated healthcare data in practice.

Collaborative Care Models

Collaborative care models are gaining traction as the healthcare system recognizes the benefits of team-based care. These models encourage physicians to work closely with other healthcare professionals, such as nurse practitioners, physician assistants and allied health providers. As a result, new payment models are being developed to facilitate and reward collaboration.

Key Takeaways for Physicians

No matter which model you work under, it’s important to regularly evaluate that your compensation is staying competitive, remunerating you appropriately for the demands of your role and meeting your work-life expectations for flexibility, balance, autonomy and more.

However slow, we are witnessing a shift away from the one-size-fits-most solution of fee-for-service to a wide variety of nuanced payment models based on physician, patient and system needs. It is critical that physicians and residents remain at the forefront of this evolution in payment models, with evidence that payment models influence practice choices and ultimately patient care.

Claim Your $150 Credit!

Get a $150 Credit when you sign up for Dr.Bill*. No credit card required.

*Terms and conditions apply.